MicroStockHub/iStock via Getty Images

IPOs can be tricky.

Buying a company that just went public comes with risks, as available data tends to be limited – at least compared to companies that have been public for many years.

Nonetheless, sometimes an IPO is so important that it deserves attention. One of them is the initial public offering of Lineage, Inc. (NASDAQ:LINE), the world’s biggest cold storage REIT.

Last month, the Wall Street Journal went with the title “Why a Cold-Storage Company Just Delivered the Year’s Hottest IPO.” The reason I’m bringing this up is because the paper started by focusing on a very important topic: supply chain resilience.

Since the start of civilization, supply chains have been critical when it comes to survival and prosperity. The pandemic was a ‘great’ example of this, as it showed what the results are of sudden disruptions. Although the worst was avoided in 2020/2021, things could have gotten a lot worse.

Going back to The Wall Street Journal article, the case was made that Lineage is mission-critical. Although these exact words were not used, the article explained that Lineage is a logistics operator most of us depend on daily – often without knowing it.

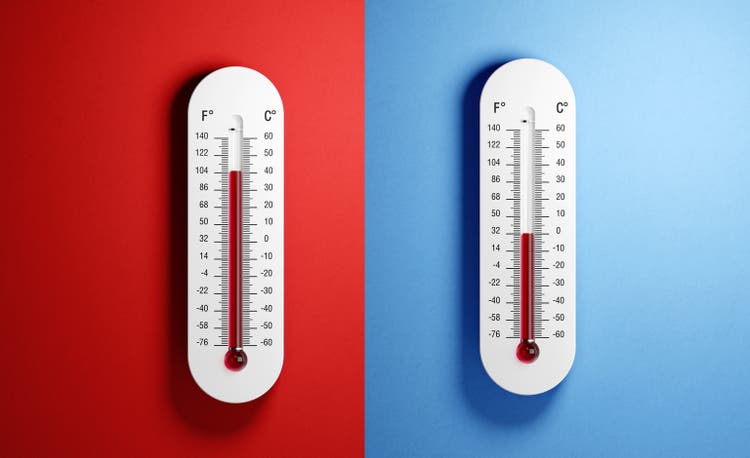

Not only is Lineage so large that its IPO was the largest IPO of the year, but it is also a giant in its industry, as no competitor comes close to its size.

In the highly fragmented cold storage industry, the company has a 12% market share with a 2 billion cubic feet capacity – twice the capacity of Americold (COLD), which has been a public company since 2018.

Lineage Inc.

So, to keep this intro from getting too long, in the second part of this article, we’ll discuss the newest addition to the public REIT space and assess how attractive the LINE ticker is for investors.

What To Make of the Cold Storage Giant?

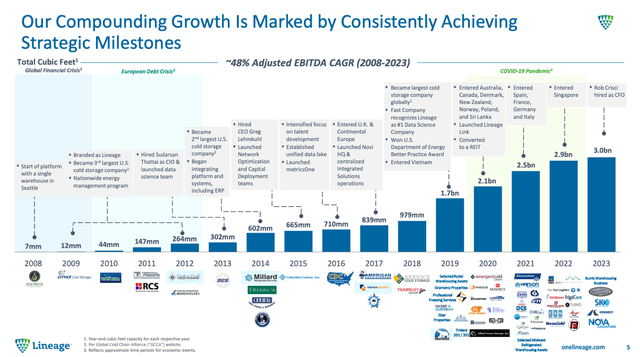

One of the many things that make Lineage interesting is the fact that this industry leader is a rather young company. As reported by The Wall Street Journal, the company was founded in 2008 by two former Morgan Stanley investment bankers, Adam Forste and Kevin Marchetti. It took them less than two decades to build a cold storage empire.

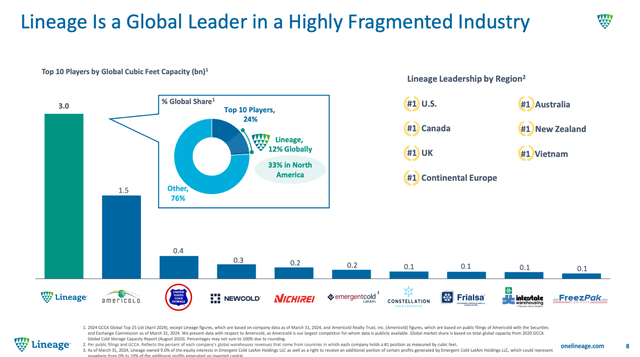

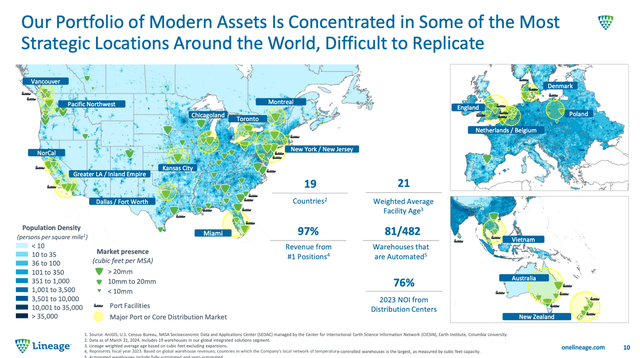

When the company went public – 16 years after being founded – it owned 482 warehouses in 19 countries that serve more than 13 thousand customers – 81 of these warehouses are either fully automated or semi-automated.

Even better, more than 40% of the company’s contracts include minimum storage guarantees and leasing revenue, which considerably lowers the risks for the company. It’s comparable to a midstream company that owns pipelines for oil and gas. In many cases, customers are paying for the right to use these assets, regardless of whether they use them.

Lineage Inc.

The secret of its expansion is M&A. In a highly fragmented industry where most warehouses are operated by family-owned businesses, the company has made 116 acquisitions since 2008 – on average, that’s more than seven deals every year.

As we can see below, most of these deals were made after 2018.

Lineage Inc.

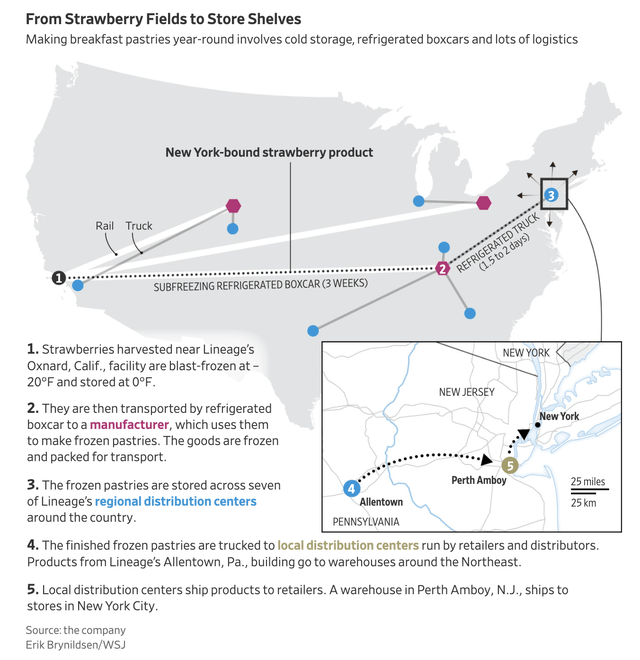

With that said, The Wall Street Journal used the map below, which is a great example of the importance of cold storage in the modern supply chain. The example shows the strawberry supply chain, which includes harvest, storage, transportation, processing, storage, and distribution to retailers.

The Wall Street Journal

Needless to say, this applies to more or less every single product in your fridge and freezer – even if you’re not American, as Lineage has significant overseas exposure, including West Europe and Asia Pacific.

Lineage Inc.

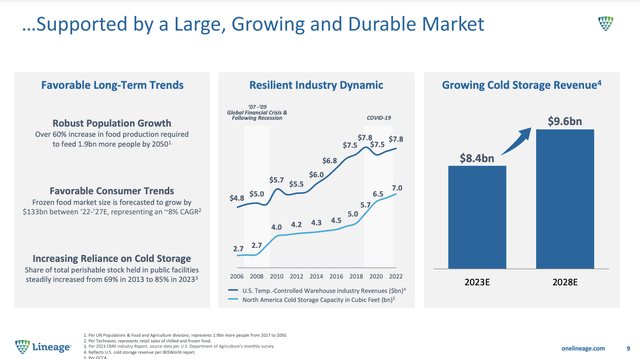

Because of secular growth trends, the industry is expected to see almost $10 billion in revenue by 2028, 14% more compared to 2023. Although this may seem like a slow increase for an industry with secular tailwinds, we need to be aware that the post-COVID period came with some challenges.

Lineage Inc.

As we can see in the chart above, after booming demand during the pandemic, demand has come down. Meanwhile, cold storage capacity increased, which created an unfavorable environment.

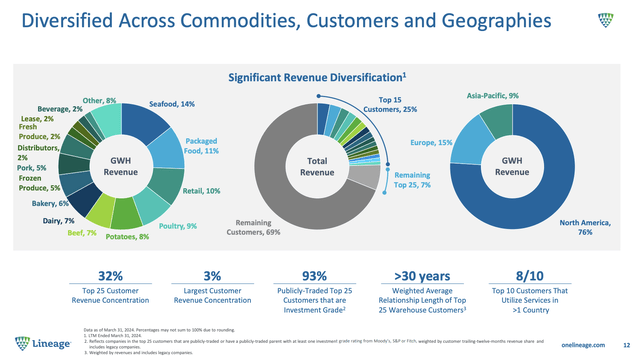

In this case, it helps that the company has a highly favorable customer base. Its largest customer accounts for just 3% of its revenue. Its largest 25 customers account for almost a third of its revenue. This lowers concentration risks.

On top of that, the company has multi-decade relationships with customers.

Lineage Inc.

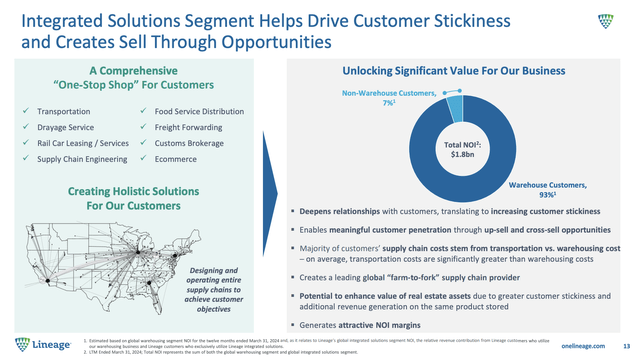

Based on this context, Lineage is more than just an owner of cold storage, as it operates two business segments:

- Global warehousing. This segment covers its buildings.

- Global integrated solutions. This segment includes supply chain services.

Essentially, Lineage has become a one-stop shop for its customers, as it offers transportation, drayage services, rail car leasing, supply chain engineering, freight forwarding, e-commerce, brokerage, and more.

This deepens relationships with customers, massively improves up-sell opportunities (if you lease the warehousing, you’ll likely opt for some services as well) and makes the company a mission-critical “farm-to-fork” supply chain player.

Lineage Inc.

This is what an automated facility looks like (robots packing and unpacking shelves):

Lineage Inc.

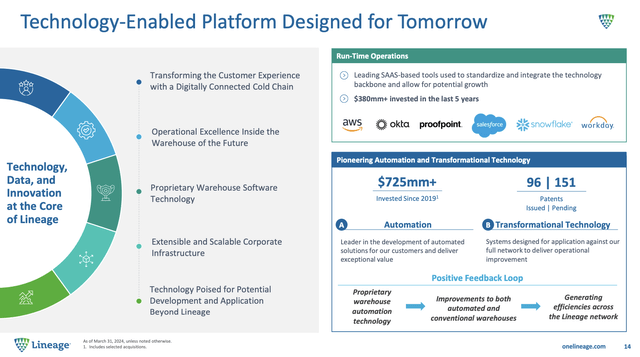

Automation does not just sound good, but it could help cut costs significantly. The typical North American cold storage warehouse spends 69% of its costs on operating costs. Real estate costs (mortgage, rent, or lease) usually account for 31% of total costs.

Of its operating costs, 51% is spent on labor, followed by electricity (14%) and repairs (13%).

Even better, because of automation, buildings can be larger, as shelves are no longer limited to the capabilities of humans operating forklifts and similar machinery.

Although I dislike it when business trends are unfavorable for labor (people need to eat), there is no denying that automation is increasingly important. Elevated inflation, rising storage needs, and new capabilities make automation a “no-brainer.”

Hence, it helps that Lineage is aggressively expanding in this area, investing hundreds of millions, and implementing advanced tools from America’s largest tech companies.

In fact, using the cloud to collect data allowed the company to build proprietary tools that made it possible to grow so quickly. Going forward, this will remain a big benefit.

Lineage Inc.

It also enjoys a BBB+ credit rating, one step below the A range.

So, what does this mean for shareholders?

No Dividend Yet and a Lofty Valuation

LINE does not pay a dividend – yet.

However, because the company is a REIT, it is obligated to pay a dividend.

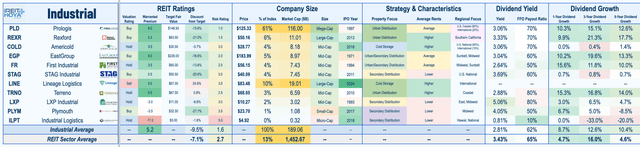

Using our own iREIT®+Hoya data, we see the average industrial REIT has an FFO payout ratio of 62%, in line with the REIT sector average of 65%.

iREIT®+Hoya

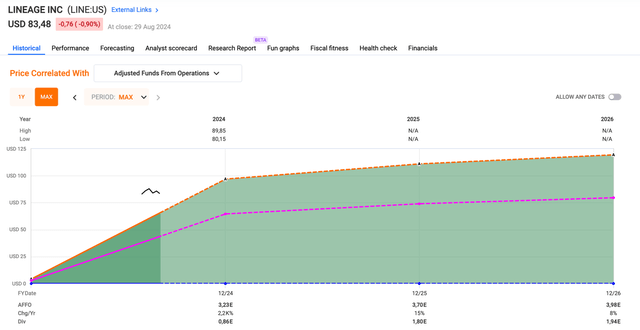

With this in mind, using the FactSet data from the chart below, the company is expected to generate $3.23 in adjusted FFO this year. This would imply a dividend of $2.00 and translate to a yield of 2.4%. This is based on a 62% payout ratio and by NO MEANS a prediction.

I’m just playing with some numbers here.

Speaking of expectations, next year, per-share AFFO is expected to rise by 15%, potentially followed by 8% growth in 2026. These numbers make sense, given falling cold storage construction, increasing pricing power, and the company’s investment in growth.

FAST Graphs

The problem is that LINE isn’t cheap.

Because the company’s IPO was so desired, there’s not a lot of meat on the bone. Currently, the company trades at 25.5x AFFO. If the stock maintains a 25x multiple, we get a fair stock price of $100, using 2026E per-share AFFO.

This would imply a 20% upside and be based on a rather lofty multiple.

As a result, we cannot make the case that LINE is a buy at current levels. However, because we like the business model and the industry, we’ll monitor the stock, as we are interested in buying it at lower prices.

In Closing

Investing in new public companies like Lineage can be challenging due to limited data and often lofty valuations.

While Lineage, which has become the world’s largest cold storage REIT, has a compelling business model with significant industry advantages, its current valuation leaves little room for upside.

However, the company’s impressive growth, mission-critical role in the supply chain, and potential future dividends make it worth keeping on your radar.

Nonetheless, given the current price, it may be wise to wait for a more attractive entry price before diving in.

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed to assist in research while providing a forum for second-level thinking.