Jonathan Knowles/DigitalVision via Getty Images

Introduction & Investment Thesis

I last wrote about e.l.f. (NYSE:ELF) in June, where I reiterated my “buy” rating with my thesis that there is plenty of whitespace in the company’s cosmetics and skin care category as it drives robust product innovation at compelling price points with buzzworthy marketing to attract and retain its users both digitally and in its retail locations in the US and internationally. Although the stock initially climbed, it has since dropped more than 17% from my price at publication.

The company reported its Q1 FY25 earnings in early August, where revenue and Adjusted EBITDA grew 50% and 4% YoY, respectively, beating estimates as it continued to gain market share for its cosmetics and skin care segments across its US and international markets in an environment where its competitors saw overall declines. At the same time, the management raised their full year FY25 revenue and earnings guidance. While revenue growth is expected to slow given tough comps as well as consumers tightening budgets, I continue to remain bullish on the company, as its compelling price points and product innovation should enable it to capture market share as it successfully engages its audience both digitally and in retail locations, leading to higher average order values and purchase frequency. Assessing both the “good” and the “bad,” I will reiterate my “buy” rating with a price target of $233.

The good: Outperformance across color cosmetics, skin care, and international sales as e.l.f. takes up market share

e.l.f. Beauty reported its Q1 FY25 earnings where revenue grew 50% YoY to $324.5M driven by continued strength in color cosmetics, skin care, and its international business across its national and international retailers and digital commerce, with enrollment in their Beauty Squad Loyalty Program growing 30% YoY, where these members tend to have higher average order values, purchase frequency, and strong retention rates.

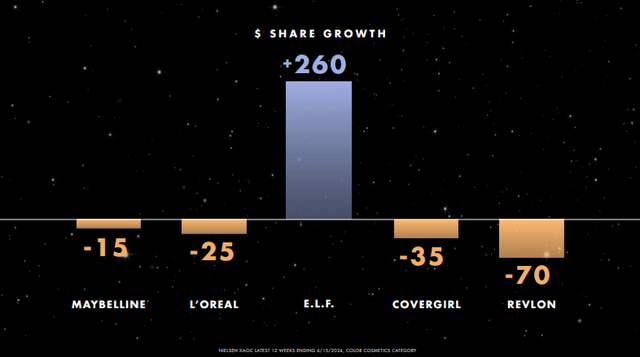

In Q1, its color cosmetics grew 26% YoY, increasing their market share by 260 basis points to 12%, with the management remaining optimistic that it can double the market share over the next few years as it replicates its successful Target (NYSE:TGT) playbook across other retailers. I would also like to point out that e.l.f.’s color cosmetics outperformed at a time when the overall category saw a 1% decline.

Q1 FY25 Earnings Slides: Market share gains in cosmetics

Meanwhile, its skin care segment also continued to outperform with 45% YoY growth, growing its market share by 60 basis points to 2% and driving e.l.f. SKIN to be a top 10 brand for the first time. Similar to color cosmetics, the company’s skin care segment outperformed the overall category by 32 times, which, I believe, is quite impressive, with the management attributing roughly 16 points to net sales growth from Naturium in Q1. With the number one brand holding 14% market share, e.l.f.’s management believes that there is plenty of runway for growth in the coming years.

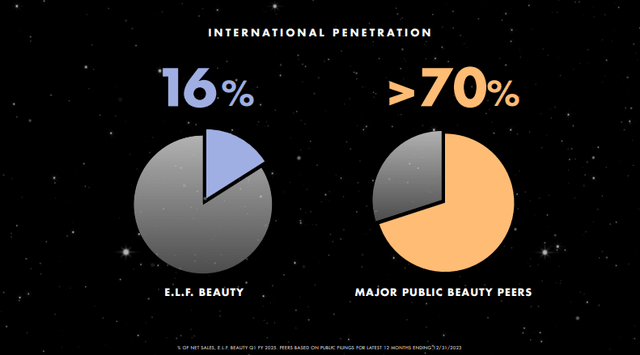

Finally, when it comes to their international segment, the company saw a 91% YoY growth, contributing 16% of their total sales, as opposed to 13% a year ago, as it partnered with leading beauty retailers to position their brands in each of their international country markets that they are expanding into while driving engagement across social platforms to attract and convert users. The management highlighted the UK and Canada as examples where they are now the number four brand, as opposed to number eight and six a year ago, respectively.

Q1 FY25 Earnings Slides: Room for international expansion

I believe that the outperformance of e.l.f. Beauty can be directly tied to a combination of its value proposition, product innovation, marketing engine, and productivity model. The company has seen their quality scores go up every single year over the last five years as they continue to deliver quality products at accessible price points, thus resulting in strong unit growth.

Meanwhile, their product innovation is centered on gathering inspiration from their community as they build successful franchises to gain market share. One of the markets that e.l.f. is looking to expand is foundation, where they launched their Soft Glam Satin Foundation in Q1 at a price point of $8, compared to a prestige item of $39, with the product being one of the best-selling ones during the quarter. Simultaneously, e.l.f. continues to drive culturally and emotionally resonant marketing content with their recently launched bronzing drops that turned into their best product launch on site, along with building an e.l.f. up experience on Roblox to connect with GenZ and Alpha audiences, thus growing their overall unaided brand awareness from 13% in 2020 to 33% in 2024. Combined with a strong value proposition, product innovation, and marketing engine, the company is also leveraging insights from their site and Beauty Squad loyalty program to maximize average sales per SKU while gaining shelf space among retailers such as Target, CVS (NYSE:CVS), Ulta Beauty (NASDAQ:ULTA) in the US, as well as Shoppers Drug Mart in Canada, Superdrug in the UK, Rossmann in Germany, and more.

The bad: Profitability margins shrank on a year-over-year basis, while inventory levels rose amid fears of macroeconomic slowdown

Although e.l.f. saw an 80 basis point improvement in its gross margins year-over-year to 71% as it benefitted from a favorable FX environment, lower transportation costs, and higher ASPs in international markets, its Adjusted EBITDA margin shrank from 34% in the previous year to 24% as SG&A expenses grew to 51% of sales, compared to 39% last year, with marketing and digital investment growing to 23% of total sales compared to 16% last year.

However, the management pointed out that these were planned investments and expect Adjusted EBITDA growth to accelerate into the back half of FY25 as they cycle the inclusion of Naturium in their financials and see normalized rates of marketing investment on a year-over-year basis. Meanwhile, their ending inventory has also grown from $98M to $200M on a year-over-year basis. While part of the reason for the inventory buildup is tied to higher consumer demand, I believe investors are cautious in an environment where consumers are increasingly financially constrained after one of the longest periods of high interest rates, leading to record high consumer credit card debt.

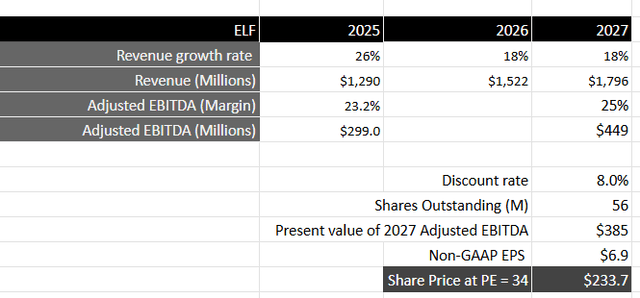

To add to that, Ulta Beauty trimmed its full-year forecast in its latest earnings call after it saw comparable sales decline driven by a decrease in transaction volume and average ticket size. This indicates that consumers are indeed cutting back spending on beauty products for the time being, which will hurt e.l.f.’s robust top line growth rates and its market share gains. However, I believe that the management is aware of that, along with the tough comps on its way, and as a result, its full year FY25 revenue guidance sees a normalization of growth rates from its current levels to the high twenties range. On that note, the management has raised their revenue and earnings guidance by 4 percentage points from its previous estimate to approximately $1.29B with an Adjusted EBITDA of $299M, representing the management’s confidence to continue to capture market share with a focus on operational efficiencies in an environment where established brands such as Maybelline, L’Oréal, Covergirl, Revlon, and others may face pressure from e.l.f.’s competitive pricing and product innovation from a price-sensitive customer.

Revisiting my valuation: Upside remains intact.

Taking the management’s revised revenue and earnings estimates into account and assuming that the company can maintain its revenue growth rate in the high teens over the following two years as it gains market share across its cosmetics and skin care segments through rapid product innovation and memorable marketing moments, thus driving higher AOV and purchase frequency in both its US and international markets, it should generate close to $1.8B in revenue by FY27. From a profitability standpoint, assuming that the company can gain 100 basis points of margin every year for the next 2 years as it streamlines its SG&A expenses towards targeted investments as well as benefits from operating leverage from its growing Beauty Squad loyalty program members, it should generate close to $449M in Adjusted EBITDA, which will be equivalent to a present value of $385M when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period with a price-to-earnings ratio of 15-18, I believe it should trade at least 2 times the multiple given the growth rate of its earnings during this period of time. This will translate to a PE ratio of 34 with a price target of $233, which represents an upside of 55% from its current levels.

My final verdict and conclusion

Despite the stock falling over 17% since my last “buy” rating, I continue to remain bullish. Although the overall macroeconomic environment may be worsening in the short term with Ulta Beauty kicking the alarm bell in its latest earnings call, I believe that e.l.f. Beauty’s FY25 revenue guidance has already taken the risk into consideration. Furthermore, I believe that e.l.f. Beauty’s compelling price points and robust product innovation will allow it to maintain and gain on its competitive positioning compared to its peers in the coming years, where it is seeing market share gains as it is able to successfully captivate its audience with resonating marketing moments translating into strong performance in its retail stores as well as enrollment into its loyalty program. While I will be monitoring its inventory levels and trend of profit margins in the coming quarters, I believe that the stock is attractively priced to drive significant long-term returns, thus reiterating my “buy” rating with a price target of $233.