cemagraphics

Clients’ top 12 holdings (listed 1-12), spread across separate accounts, custodied at Schwab, as of 8.31.24 (YTD returns as of 8/31/24):

- JPMorgan Income Fund (JPMIX), YTD return +6.09%

- Microsoft (MSFT) +11.53% YTD return

- JPMorgan (JPM): +34.13% YTD return

- Nasdaq 100 (QQQ): +16.64% YTD return

- Amazon (AMZN): +17.48% YTD return

- Oakmark International (OAKIX): +1.15% YTD return

- Schwab (SCHW): -4.29% YTD return

- Netflix (NFLX): +44.05% YTD return

- S&P 500 ETF (SPY): +19.35% YTD return

- Alphabet (GOOGL): +17.10% YTD return

- Emerging Markets ex-China ETF (EMXC): +10.41% YTD return

- Walmart (WMT): +48.15% YTD return

JPMorgan, Netflix and Walmart are the big outperformers YTD. Microsoft, Amazon and the Nasdaq 100 now underperforming the S&P 500 YTD.

(Found below in a different section of the blog, looking at SPDR ETF returns by sector, XLK (technology) is the only ETF that has a lower total return YTD today, August 31 ’24, than on June 30 ’24.)

Oakmark’s weight has been cut in half since the last time the “top 10” was updated, on July 4, 2024 (here). David Herro – the International portfolio manager of the decade between 2000 and 2009 – is the Oakmark Int’l PM that is top dog on the Oakmark International team. It’s been tough to suffer through the performance differential between Oakmark and the S&P 500. Any international fund or ETF that doesn’t have a US component (ex-US) is seeing single-digit returns, but the last 30 to 60 days, perhaps due to the weaker dollar, the asset class is starting to stir. Clients’ other two Non-US ETFs held are the EMXC (listed above, and +10.41% YTD), and the Vanguard Developed Market ETF (VEA), +11.04% YTD, are at least up more than 10% YTD.

My biggest worry about international, emerging markets, and Non-US investing is that (I suspect) China’s growth in the late 1990s through the great financial crisis drove much of the European and emerging market returns back 15-20 years ago, when the BRICs were red-hot (Brazil, Russia, India, and China).

China’s GDP growth – while of low quality – grew 10-15% per year from 2000 through 2009 and a little beyond. Today, China’s annual GDP growth is a far cry from that growth rate, with little evidence that it will return to anywhere close to that level.

JPMorgan has a neat little international fund – JPMorgan Developed Int’l Value (JFEAX) – which is being acquired in small amounts at present. The fund is up 15.27% YTD as of August 31, with no US exposure (it’s hard to find an international fund up 15% YTD with no US large-cap stocks) but a heavy overweight in financials. Of the top 10 holdings, five stocks have euro or British pound currency. The 10-year annualized return on the JFEAX is 3.99%, while the 10-year annualized return on the S&P 500 (SPY) is 12.88%. (All return data sourced from Morningstar.)

Portfolio construction is like a professional sports team: you need your big dogs to show up on the big day and make the big plays (i.e., outperform), and the supporting cast has to not detract from team performance (i.e., don’t be too divergent in terms of benchmark returns).

Sector performance under loosening monetary policy

Moving on, the last relatively normal period when the Fed / FOMC / Jay Powell reduced the fed funds rate was the year 2019, after the fed funds rate hikes started by Janet Yellen.

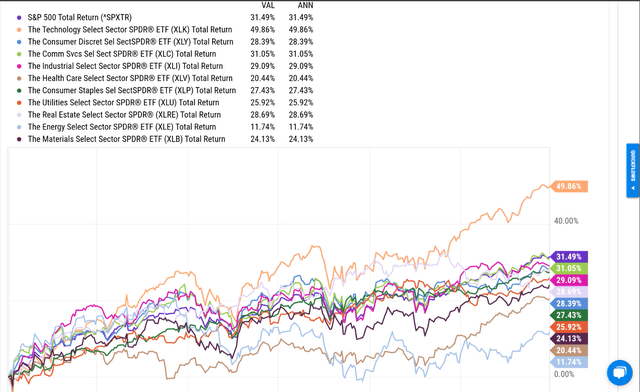

Here’s how the various sectors performed in 2019 as Jay Powell reduced the fed funds rate from close to 3%, to end up between 1.5% and 1.75% in September 2019, where it remained until March 2020.

Healthcare (XLV) and energy (XLE) were laggards in 2019. Energy was downright awful that year.

Only technology beat the S&P 500, while consumer discretionary (XLY) (Amazon and Tesla) and communication services (Google and Meta) were close. Financials too (XLF) returned 29% in 2019.

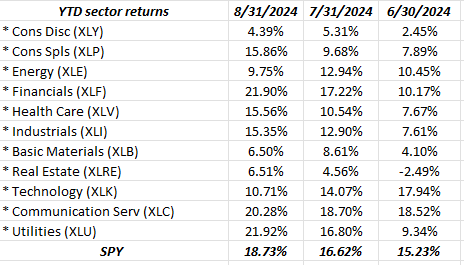

Today, we are starting to see financials (XLF), real estate (XLRE) and utilities (XLU) – all long considered interest rate-sensitive sectors – start to outperform.

Here’s the last 3 months returns for the same sector ETFs used above. (Return source is Bespoke Weekly Report.)

Financials have doubled in the last 60 days, technology has lost 700 bps of return, falling from a +17% return on the XLK as of June 30 ’24, to +10.71% as of August 31. In fact, technology (XLK) is the only SPDR ETF that has lost ground since June 30 ’24 in terms of YTD total return. (See the table just above.)

Final comment: High-yield credit continues to trade very well, even as TLT fell 1% Friday, 8/30/24, on above-average volume. Corporate high yield’s continued positive returns – the best of the various fixed-income classes with the exception of emerging market credit, which is also performing well – tells us that recession risk remains low.

Lots of employment data this coming week, the August nonfarm payroll report expecting +150,000, (138,000 for private payrolls) “net new jobs added” to the US economy in August ’24. We also get JOLTS on Wednesday morning, ADP Thursday morning, September 5th, as well as jobless claims (Source: Briefing.com).

None of this is a recommendation or advice, but only an opinion. Past performance is no guarantee of future results. Investing can involve the loss of principal, even for short periods of time.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.