Klaus Vedfelt

Most readers know me for my REIT analysis on Seeking Alpha. I’ve been writing on this platform for over 14 years, and I’m the most followed analyst with over 116,000 followers.

One of the things that I love about Seeking Alpha is the interaction with reader comments. I enjoy responding to questions about individual stocks, macroeconomic news, or just about anything except politics.

As I reflect on my time writing on Seeking Alpha, I recount one of the most popular questions:

“How many REITs should you own?”

So, I decided to answer this question in my new book:

“I get this question a lot, and my standard reply goes something like this: More than one, and make sure you’re adequately diversified across property sectors and geography. In other words, don’t invest in a single stock and then assume you have your REIT bases covered.

In general, I like to see investors own no less than 10, with roughly 10% of their REIT-specific funds invested in each company. However, if you have 30% of your equities invested in REITs, I suggest you consider owning closer to 20 REITs, with 5% devoted to each.

That being said, risk tolerance plays a big role in constructing an intelligent REIT portfolio, as I explain.

“…in general terms, I consider 10-20 REIT positions reasonable. Just make sure to diversify across property sectors and geographies along the way. And consider allocating some capital to REIT preferreds and/or bonds as well.”

With that being said, I decided that I would put together a research report for a 10-stock REIT portfolio. The goal here is to select 10 REITs diversified across property sectors that are trading at a discount.

In this article, I will begin my series with three REITs for the 10-REIT Retirement portfolio. I will write two more articles soon that will incorporate 10 REITs with a few preferred bonus picks.

Sun Communities (SUI)

SUI is a leading owner of Manufactured Housing (45%) and Recreational Vehicle Communities (26%), Marinas (21%) and UK Properties (8%).

The REIT has around 180,100 operational sites and 48,200 wet slips and dry storage spaces, which makes the company the largest in the sector.

The manufactured housing portfolio is 96.7% occupied and 89% of the marinas have a waitlist. SUI is the 2nd largest owner/operator in the UK (18k MH sites) and the portfolio is 88.9% occupied.

In Q2-24, SUI had a solid report record: core FFO per share was $1.86 and NOI growth was 3.6% (9.3% in the UK). The manufactured housing business generated NOI growth of 6.4% due to solid rental rate growth and occupancy growth.

The RV segment was not as good, as NOI decreased 4.6% due to weakness in transient demand. The marina segment generated solid NOI growth of 6.1%

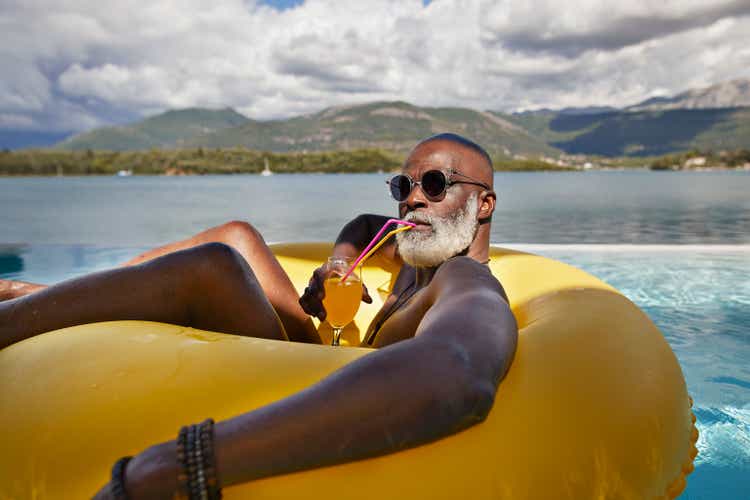

In Q2 SUI reaffirmed its prior FY guidance for Core FFO per share of $7.06 to $7.22 which equates to flat growth in 2024. However, consensus AFFO per share estimates for SUI are 7% in 2025 and 13% in 2026.

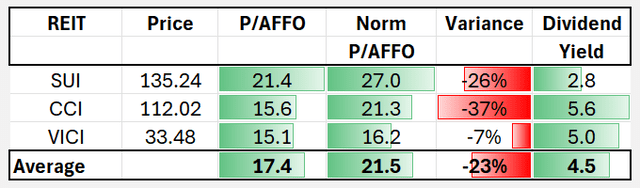

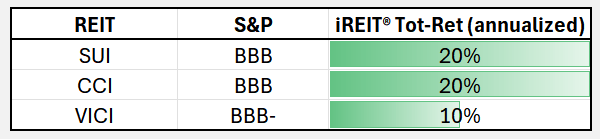

SUI is now trading at $135.24 per share with a divided yield of 2.8%. The payout ratio is 60% (based on AFFO) which means SUI is likely to boost its dividend substantially over the next few years. As show below (using FAST Graphs) we anticipate SUI could return 20% to 25% annually.

FAST Graphs

Crown Castle (CCI)

CCI is a cell tower landlord with a portfolio that consists of more than 40,000 cell towers, approximately 115,000 small cell nodes and approximately 90,000 route miles of fiber.

These shared communication assets allow investors to capitalize on 5G deployment with a compelling total return opportunity set (lower risk profile with 100% of assets in the US).

In the US, there’s higher demand for data as the US attracts a disproportionate share of global network capital investment. North America accounts for around 30% of expected global wireless capex through 2025 (compared with 5% of the world’s population).

In Q2-24 CCI delivered solid results highlighted by 4.7% consolidated organic growth consisting of 4.4% growth from towers, 11% from small cells, and 3.2% from fiber solutions (above expectations of 3%).

As referenced in a previous article by Leo Nelissen, CCI is “actively working on a strategic review of its fiber segment, looking into alternatives to improve shareholder value. According to the company, it worked with potential third parties that show interest in its fiber solutions and small cell business.”

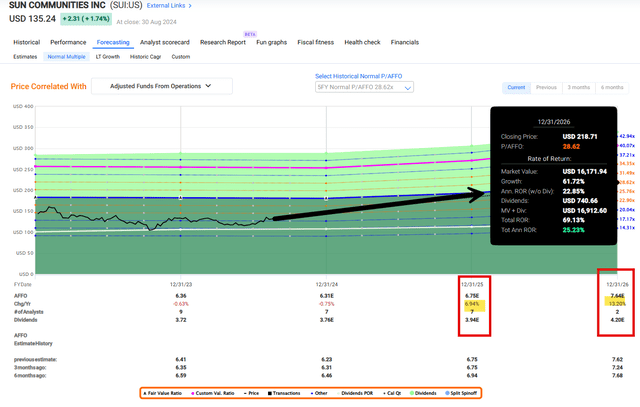

Since my last article, CCI shares have rallied by 16% (compared with the S&P 500 of 3.4%); however, we are maintaining a BUY given the current valuation.

Currently, shares trade at $112.02 with a P/AFFO multiple of 15.6x (compared with the normal value of 21x). The dividend yield is 5.6% with a payout ratio of 90%. This is higher than we would like to see, especially when considering the fact that American Tower’s payout ratio is just 61%.

Analysts expect negative AFFO per share in 2024 of -8% and flat growth in 2025, before returning to growth of around 4% in 2026. Our longer-term forecast suggests that CCI could return 20% annually, as show below (via FAST Graphs).

FAST Graphs

VICI Properties (VICI)

VICI is a gaming REIT that continues to evolve into their unique “experiential” property categories.

In addition to owning three of the most iconic entertainment facilities on the Las Vegas Strip (Caesars Palace, MGM Grand and the Venetian) VICI owns 90 other experiential assets across a geographically diverse portfolio consisting of 54 gaming properties and 39 other experiential properties (in the US and Canada).

VICI’s portfolio consists of approximately 127 million square feet and approximately 60,300 hotel rooms and over 500 restaurants, bars, nightclubs and sportsbooks.

To further enhancement of the portfolio, VICI has a growing array of real estate and financing partnerships with operators including Bowlero, Cabot, Canyon Ranch, Chelsea Piers, Great Wolf Resorts, Homefield, and Kalahari Resorts.

In Q2-24, VICI delivered solid results, increasing AFFO per share by 5.9% and the company has the highest net income margin in the S&P 500, as noted in an article published by Barron’s during the month of July.

VICI said it was raising AFFO guidance for 2024 to between $2.35 billion and $2.37 billion, or between $2.24 and $2.26 per diluted common share. The midpoint of the range represents 4.7% YOY AFFO per share growth.

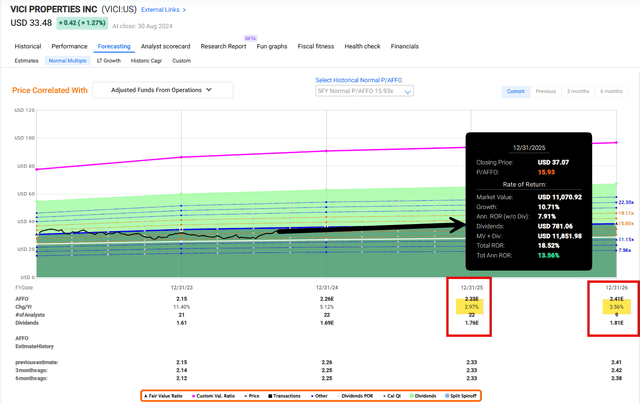

VICI is currently trading at $33.48 per share, with a P/AFFO multiple of 15.1x (normal is 16.0x). The dividend yield is 5.0% with a payout ratio of 75%. As shown below, analysts forecast growth of 3% in 2025 and 4% in 2026. Although shares have returned over 16% since my article in May, we still think shares are worth buying.

FAST Graphs

In Closing

SUI, CCI and VICI are the first picks in my Retire Rich with REITs portfolio. I have included these below, and I will add the new REITs and track them at iREIT® + HOYA.

Retire Rich with REITs

iREIT®

iREIT®

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.