wildpixel

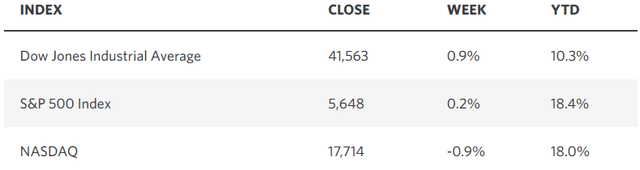

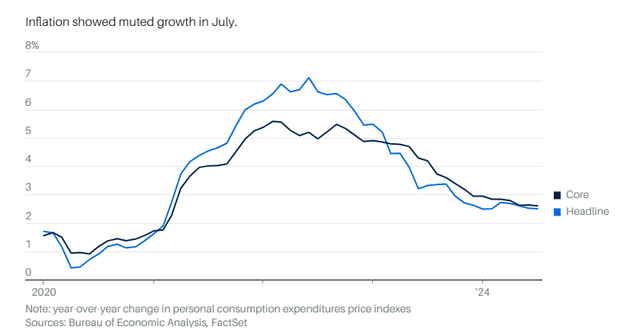

The S&P 500 finished last week on another positive note, as a better-than-expected inflation report led the index higher for a fourth month in a row. The personal consumption expenditures (PCE) price index, which is the Fed’s preferred inflation gauge, increased 0.2% in July, which resulted in a year-over-year increase of 2.5%. The core rate, which excludes food and energy, also rose 0.2%, increasing 2.6% on an annual basis. More importantly, the annualized increase in the PCE over the past three months has fallen to 1.8%, which is below the Fed’s target of 2%. There is no longer a debate about whether or when the Fed will begin to reduce borrowing costs. The discussion now is about how rapidly the rate cuts will be realized.

Edward Jones

As the Fed begins to reduce interest rates at its September meeting, inflation fears have naturally shifted to growth concerns. As expected, the labor market is softening, but the downward revision of approximately 800,000 jobs created in the year ending this past March by the Bureau of Labor Statistics has some investors worried. I am not one of them. In terms of leading indicators, focusing on job creation is akin to driving in the rear view mirror. Granted, new jobs create additional income, which fuels the consumer spending that drives nearly 70% of our economic activity. Yet it is the existing workforce of 160 million and their income that is the primary fuel for consumer spending and economic growth. Therefore, the focus should be on the rate of growth in spending rather than job creation. When spending growth slows to the degree that job losses will follow, it is time to become more defensively positioned.

Barrons

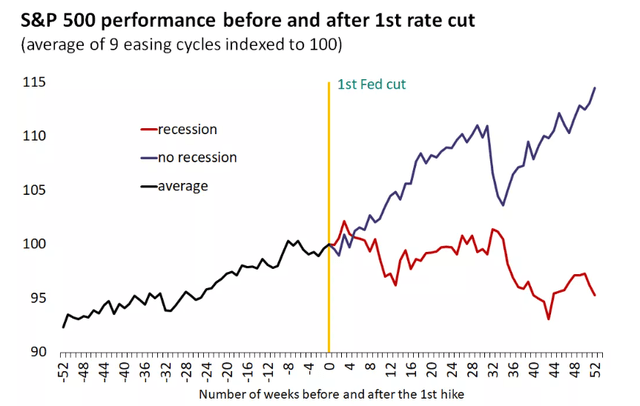

Investors should expect to be inundated with opinions in the days and weeks ahead about whether a rate-cut cycle is bullish or bearish for the stock market. The truth is that it depends on whether the economy continues to expand or is on the cusp of a downturn. When the Fed lowered short-term rates during periods of decelerating but sustained economic growth it was a bullish development. Obviously, when the rate cuts were accompanied or followed by a recession, it was extremely bearish. Therefore, my focus will continue to be on the leading economic indicators that I think are the most relevant in this post-pandemic period. I have spent the past two years rebuking what were historically reliable ones that gave false positives due to post-pandemic anomalies. I think most of those anomalies are behind us now.

Edward Jones

While there have been signs of stress in lower-income consumer balance sheets, in aggregate, the consumer looks to be on firm footing. Positive factors for the economy include jobless claims, retail sales, the service sector PMIs, real income growth, and the steady increase in year-over-year personal spending on an inflation-adjusted basis. The expansion is on track to continue.

We should see more new all-time highs for the major market averages, but they are likely to be harder fought with more tempered gains than the first half of the year, as rotation from the largest and most influential technology leaders continues into the rest of the market sectors. This improvement in breadth could be seen last week, as the equally weighted S&P 500 achieved a new all-time high.

Investors should also anticipate more volatility during September, which has historically been a turbulent month, especially with the Fed meeting on deck and Presidential election approaching. That volatility should provide opportunities for targeted investing, as it did during the August market pullback.