BING-JHEN HONG

Last week, all eyes were on chipmaker Nvidia (NASDAQ:NVDA) as the company released its fiscal second quarter results. While the chip giant showed solid top and bottom-line beats, and also issued current guidance that was above the street’s estimate average, shares sold off more than 6% the following day. At this point, the company is working to digest some growing pains, but the long-term future here still looks bright.

Previous coverage on the name:

It was back in late May when I covered the name after its fiscal Q1 report. I discussed how the story was starting to get interesting now that last year’s revenue growth surge anniversary was being lapped. This meant that top-line percentage increases would soon show sharp declines, primarily thanks to the law of large numbers, something that long-term investors might worry about.

Nvidia shares have jumped more than $10 since my previous article, putting the stock right around its 50-day moving average. However, the stock remains well above its 200-day, which is currently under $90, so the stock is quite elevated in the long run. It will be interesting to see if we get a buy the rumor, sell the news type event with the markets in a few weeks as the Fed is expected to cut rates this month.

The fiscal Q2 report:

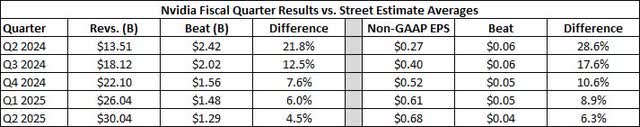

When your stock more than doubles over the past year, both investors and analysts are going to have some lofty expectations. That was certainly the case for Nvidia, as street estimates have been surging since last year’s “shock and awe” guidance quarter. As those estimates rise considerably, however, it makes it harder and harder for the company to beat by large margins. As the table below shows, the latest quarter had the smallest beats in the last five periods for both the top and bottom lines.

Nvidia vs. Street Estimates (Seeking Alpha)

For the quarter, revenues of more than $30 billion were up 122% over the prior year period. As expected, the Data Center represented almost all of those total sales, and the segment grew 154% over fiscal Q2, 2024. Each of the company’s three other segments showed normally solid growth, anywhere from 16% to 37%, but these increases pale in comparison to what the Data Center has done recently.

The one item that investors and analysts will be focusing on a bit more in the coming quarters is gross margins. Non-GAAP gross margins were down more than three percentage points sequentially, and are expected to decline a little more in the back half of the fiscal year. For the moment, margins are being pressured by the start of the Blackwell production ramp, with samples currently being shipped. A year from now, we’ll have an idea of how that product is really doing, and whether or not Nvidia can keep its gross margins sky-high. As a reminder, the 75.7% non-GAAP gross margin figure seen in Q2 was up nearly thirty percentage points from just two years earlier, a profitability surge virtually unheard of.

Looking forward a bit:

For the current quarter, fiscal Q3, Nvidia management guided to revenues of $32.5 billion, plus or minus 2%. That number was ahead of the street average by about $750 million, but it seemed expectations might have been a tad higher. As a point of reference, Q2 guidance at the earnings report about three months ago was $1.16 billion ahead of estimates, so like the actual results, guidance beats have been coming down.

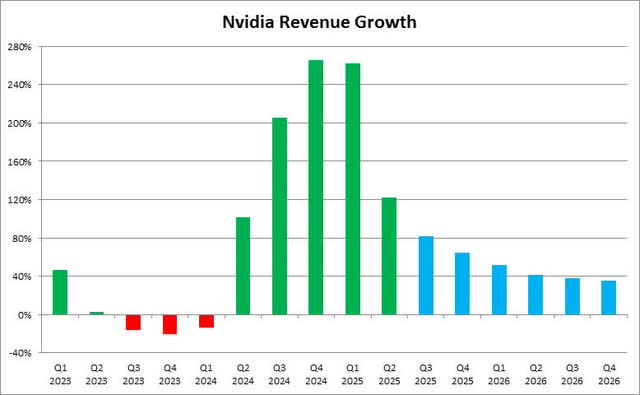

The overall top-line increases will start to moderate a bit more as we continue forward, as each subsequent quarter now puts a much higher prior year period number in the rearview mirror. While analyst estimates in dollar terms continue to rise, it’s extremely hard to keep revenue growth at 100% or more for an extended period of time. The chart below shows a recent history of Nvidia’s quarterly revenue growth, with bars in blue representing current analyst estimates for periods not yet finished.

Nvidia Revenue Growth and Current Estimates (Seeking Alpha)

Whether or not Nvidia hits these marks will depend on the Blackwell ramp. It is expected to start in the fiscal fourth quarter of this year and continue into fiscal 2026. On the conference call, management said it expected several billion in Blackwell revenue in Q4. That number should increase rather nicely next year, although analysts didn’t get as much color as they were hoping for on the call, which may have been one reason the stock was under pressure.

The current valuation:

One of the reasons I bring up the slowing growth is that the rise in shares since my previous article has pushed Nvidia’s valuation up quite a bit. At the end of last week, the stock went for 42 times this fiscal year’s expected non-GAAP earnings. That number is up about 2.5 points in three months and 10 points in six months. You are getting a bit of growth here, but you are definitely paying for it.

At the same time, we’ve seen Intel Corporation (INTC) go from 28.0 to 84.3 since, with Advanced Micro Devices, Inc. (AMD) going from 47.3 to 43.9. Intel’s valuation has soared just because estimates have been cut so much towards the flat line, but the chip giant’s figure drops into the teens if you look out a year or two. If we look at each of the three’s next respective fiscal year, Nvidia goes for 30 times, a sizable premium to the 22.77 times the other two names currently average.

Final thoughts:

Nvidia reported some solid all-around results last week, but it wasn’t enough to power shares higher. With expectations rising tremendously over the past year, beats have been smaller each quarter recently. As the company is lapping some of last year’s major revenue growth quarters, its top-line percentage growth numbers are coming down from well into the triple digits. All eyes now are on the Blackwell production ramp, which is slated to deliver the next leg of overall revenue growth into calendar 2025.

For the moment, I am going to keep a hold rating on Nvidia shares. While I like the long-term story, I’m not a fan of buying a high-valuation name as it shows slowing top and bottom percentage growth rates. September has also averaged a 4.5% decline for the NASDAQ over the past six years. Perhaps if Nvidia shares get down to the 100-day moving average (currently at $110 but rising), we can look at the name again then.