John M Lund Photography Inc

Summary

Following my coverage on Ciena Corporation (NYSE:CIEN) in Jun’24, in which I recommended a buy rating due to my expectation that CIEN has gone past the trough of this demand cycle and that growth will start to accelerate once the inventory surplus situation fully normalizes in FY24, this post is to provide an update on my thoughts on the business and stock. I still give a buy rating as I see the 3Q24 performance as solid evidence that CIEN has entered a growth cycle.

Investment thesis

Yesterday, CIEN released its 3Q24 earnings, which saw revenue of $942 million, which beat consensus estimate of $928 million and is at the high end of the management-guided range ($880 to $960 million). Gross margin fared pretty well, stable against 2Q24’s 43.5% with 43.7% in the quarter and is 100 bps higher than 3Q23’s 42.7%. However, this quarter saw better cost control, where Opex as a percentage of revenue fell by 100bps vs 2Q24 to 35.7%. Hence, adj net income saw strong growth, which drove adj EPS to $0.35 vs. consensus estimate of $0.26.

Own calculation

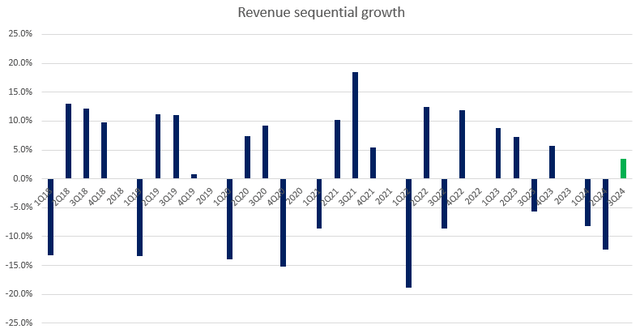

As I have written previously, I believe the worst of the cycle is over, and indeed, CIEN posted solid sequential revenue growth in 3Q24, further supporting my view that a growth cycle is materializing. Looking ahead, I expect CIEN to continue printing acceleration growth for two reasons.

Firstly, growth in 3Q24 was driven across all major customer segments, where direct cloud providers grew 9% sequentially and the cloud customer base showed robust demand trends. In particular for the latter, CIEN continues to see strong traction in AI and cloud network infrastructure investment (i.e., data centers, subsea cables, long-haul cables, etc.) and that it has secured a growing number of new wins across various applications. In addition, 3 out of the 4 major cloud providers are ramping up their demand for CIEN’s 400ZR (this highlights the growing underlying demand for network connectivity). CIEN is also adding a lot of new customers in this space (now has 122 customers, vs. 104 in 2Q24 and 86 in 1Q24). I also point out that CIEN now has 23 orders for WaveLogic 6, up from 14 in 2Q24. This figure should continue to go up as WaveLogic 6 is a superior product vs. WaveLogic 5 and as it rolls out the pluggable solution by the end of the year. As for service provider customers, the global pipeline also continues to increase and should continue to improve as North American service providers are starting to show signs of improved business trends, especially as CIEN is seeing a normalization in purchasing patterns.

Secondly, the growing adoption of AI has put a lot of pressure on providers to step up on AI training, which has driven up the intensity of workloads. In the past, data-intensive AI training workloads were done at data centers because they were closer to the edge (lower latency and faster response times). In this case, since data traffic stays within the premise, CIEN does not benefit from the data flow. In my opinion, the demand for AI (and consequently AI training intensity) will only go up from here as adoption increases. The constraints that cloud providers (or any AI solution provider) will face are power consumption and real estate space (how many GPU clusters can fit in the data center). When that happens, providers may need to build GPU clusters across multiple data centers, connected through optical cables, to support that level of demand. If this plays out, it should translate to a sizeable network traffic that CIEN can benefit from.

I think the second one that you mentioned is as the data rates between GPUs are increasing and because of the power usage and the restrictions on power forcing more distributed architectures in these GPU clusters, the length of the links that need to get communicated, those coherent technologies, in our belief, are going to start to make their way inside sort of more of the traditional clusters. 2Q24 earnings results call

Another thing I would like to highlight is that CIEN has made significant progress in their supply chain. As CIEN exited 3Q24, the business has completed three quarters of the entire progress, which so far has resulted in: (1) having direct sourcing relationships with the major component suppliers; (2) a more diversified supply chain geographically; and (3) additional supply chain resiliency as products are re-designed to accept components from multiple sources. As CIEN completes this transformation, it should yield better cost control over time and improved revenue quality (lesser volatility in times of supply shock).

Valuation

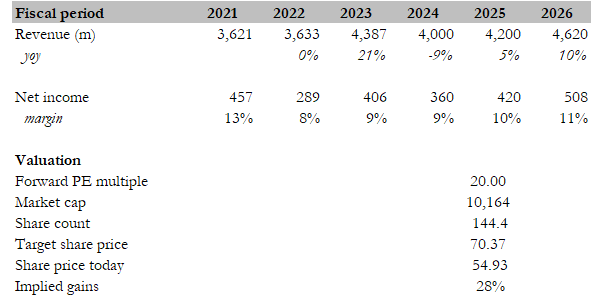

Own calculation

I left the key assumptions for my model intact, as 3Q24 performance reinforced my view that growth will continue to accelerate from here back to 10% in FY26 (pre-covid growth rates). That said, I reiterate my point that this growth may be proven conservative depending on the pace of AI investments. Net margin should continue to improve as I expected previously. Again, I note my assumption may be conservative because of the progress made with improving the supply chain (hard to size the impact of this change at the moment). What has changed in this updated model is that I assumed CIEN to trade at 20x forward PE instead of 18x. The reason for this upgrade is because I believe the market is willing to attach a premium multiple (relative to history) in the near term as CIEN growth accelerates (proving that the growth cycle is here).

Risk

Orders received from customers may not translate into revenue if they decide to defer implementation, which can easily happen if the economy tips into a recession (forcing companies to take a step back in growth investments).

One-quarter of revenue sequential growth may not be indicative of a growth cycle. If growth turns negative in the next quarter for whatever reason, it may hurt the equity narrative, and valuation may be pushed down from the current premium levels.

Conclusion

In conclusion, my rating for CIEN is a bullish one, as the business saw positive demand trends across all major customer segments. Additionally, CIEN’s progress in supply chain optimization should result in better cost control and higher revenue quality over time. While there are potential risks associated with economic downturns and the possibility of deferred orders, I believe CIEN is well-positioned to benefit from the growing market for network connectivity.