Thitima Uthaiburom/iStock via Getty Images

Investment Thesis

DocuSign, Inc.’s (NASDAQ:DOCU) FY 2025 Q2 results gave investors a strong performance despite the market’s pessimism on this COVID darling. The digital signature and contracts management company exceeded expectations in terms of revenue and adjusted earnings per share (it was a really solid quarter all around).

As of the time of this writing, shares are up slightly today (Friday), up 2.46% as I think investors are starting to price in the concept that this COVID stock has a really important place in the enterprise tech stack as AI becomes a much bigger part of how businesses operate.

With this, DocuSign recently appointed key new executives as part of their Intelligent Agreement Management (IAM) platform which, I think, is at the heart of their new AI opportunity.

With the appointment of Paula Hansen as President and CRO, and Sagnik Nandy as Chief Technology Officer, the company is overhauling their sales and engineering divisions which, I think, will help accelerate growth.

I think this management reorg resembles the bold, leadership-driven turnaround approaches that were made recently at PayPal Holdings, Inc. (PYPL) and Zoom Video Communications, Inc. (ZM), where shifts in company strategy, and some executive changes, have corresponded to the beginnings of successful attempts to turnaround each respective company. Both companies have seen their shares outperform in recent months.

With this, I think shares remain a strong buy post earnings. The company is being bold, and it’s starting to pay off. I think the market will price this in next.

Why I’m Doing Follow-Up Coverage

Since my last coverage on DocuSign in June, shares have increased by 8.87%, beating the market’s return of 1.34%.

Back in June, I started my coverage as a strong buy, driven by personal optimism about their expansion into AI-driven contract lifecycle management and the acquisition of Lexion, which I think helped open up new markets. Despite the stock’s significant drop post-COVID ending, I’ve been bullish on the story as a tool companies use both in the office and outside of the office.

2023 was said to be the year that employees went back to their offices.

In 2023, 52% of employers globally reported that their main goal for their return-to-work mandates was to build or maintain culture or connection.

Despite this trend which was part of the reason we saw shares drop from their highs in 2021, the company is a key part of the future of all workplaces (in-person and remote).

The electronic signature software market continues to grow rapidly, with projections estimating the market will reach $35.7 billion globally by 2030.

In essence, I am doing follow-up coverage because I think the market’s concerns are overdone here, and it’s now starting to realize it with this solid quarter and new management.

Q2 Review

DocuSign delivered solid results in their 2Q 2025 earnings report, which surpassed both revenue and EPS expectations. Their non-GAAP EPS reached $0.97, exceeding analysts’ projections by $0.16. Revenue clocked in at $736 million, beating consensus by $8.16 million.

But management did not stop there, as DocuSign’s Q3 guidance points to further revenue growth (also above estimates), projected to come in between $743 million to $747 million, higher than the estimates of $739.59 million.

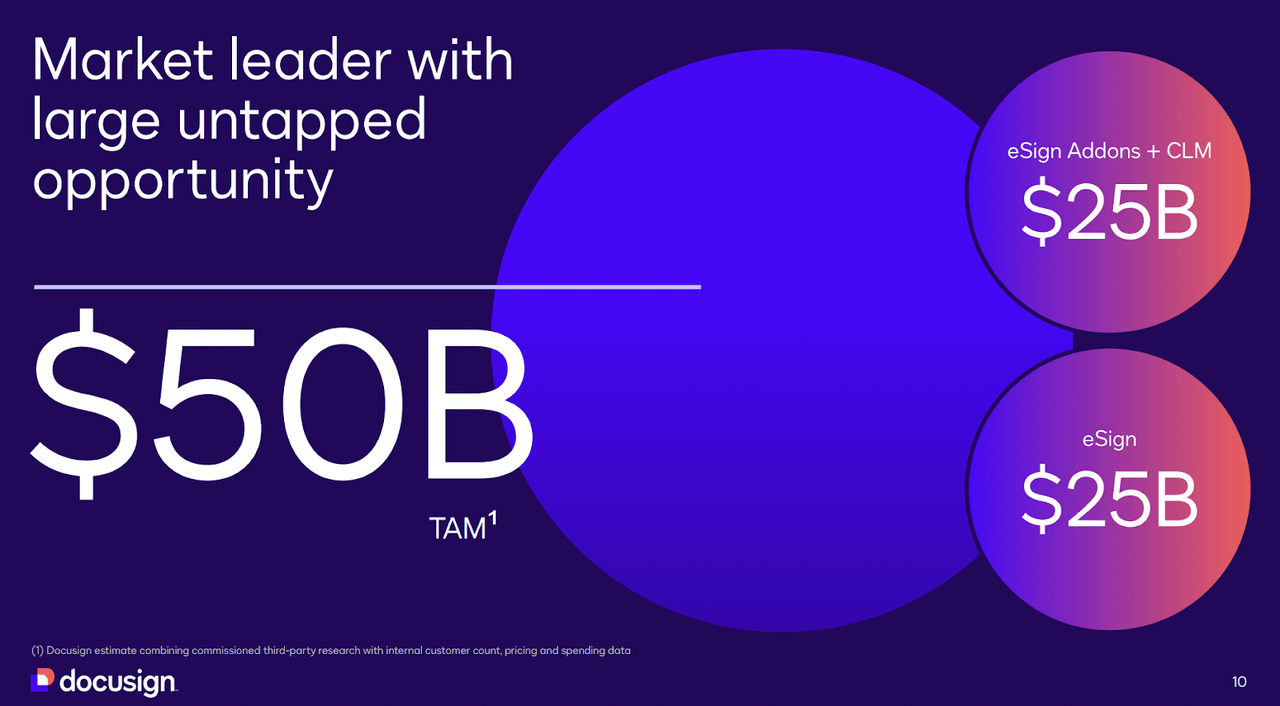

The company’s gross margin is holding steady at around 80% (82.2% this quarter specifically), and I think their investments in cloud contract solutions suggest they can certainly capitalize on the growing demand for AI-driven contract management systems. DocuSign thinks there is a massive TAM here they can go after. I agree.

TAM Slide Q2 Earnings (DocuSign)

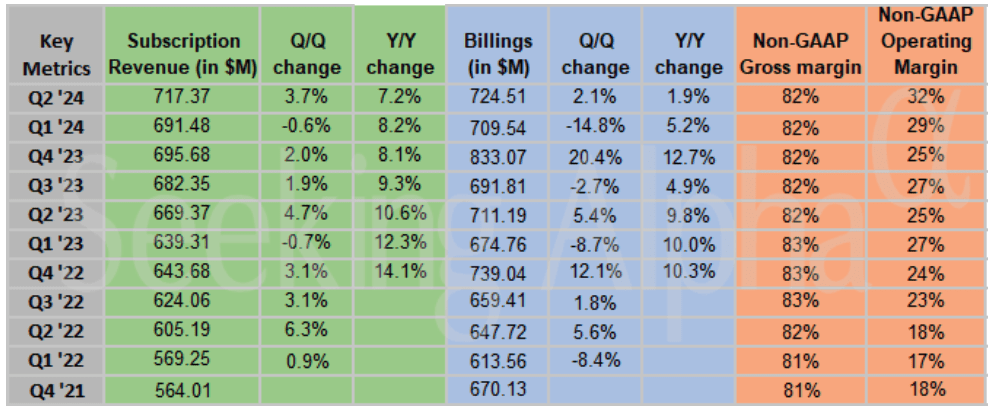

Part of the foundation of this quarter’s beat was subscription revenue, which came in at $717 million, up 7% from the previous year. While the company maintains a large recurring revenue base, the growth rate has decelerated from the higher double-digit percentages seen in earlier years (COVID). I think we’ll see this reaccelerate as their IAM offerings pick up steam.

Key Revenue Metrics (Seeking Alpha)

During their Q2 2025 earnings call, CEO Allan Thygesen emphasized the company’s core tenants of their turnaround strategy, highlighting the introduction of their new Intelligent Agreement Management (IAM) platform as a foundation for future growth. Thygesen noted:

In Q2, we shipped the first version of our Intelligent Agreement Management, or IAM, platform. This is the most important launch in DocuSign’s recent history because of the value we believe IAM will create for our customers. IAM addresses the massive $2 trillion in lost economic value each year experienced by organizations when managing agreements.

In Q2, IAM launched to small and mid-sized commercial customers in the United States, Canada, and Australia. It’s very early days, but the initial results and customer feedback are promising. So far, IAM customer win rates are higher, average deal sizes are larger, and time to close with customers is faster. Customer deal count and bookings are increasing month over month, with August being larger than June and July combined -Q2 Call.

The company also welcomed their new leadership. CEO Thygesen added:

We’re excited to welcome new Chief Revenue Officer, Paula Hansen, and Chief Technology Officer, Sagnik Nandy, who’ve both hit the ground running after starting in early August. Paula and Sagnik bring large-scale experience selling and building enterprise-customer solutions, and complete an already strong leadership team.

We are excited to continue our transformation journey. IAM represents a massive opportunity to leverage our market leadership and unlock incredible value for customers as the system of record for agreements -Q2 Call.

The company appears to have a rock-solid vision and new leadership to power the way. I agree, while DocuSign is known for contract signature software, this new IAM system has even greater promise.

Valuation

Even with the company’s impressive turnaround plan, shares are currently trading at a discounted P/E ratio compared to the broader technology sector median. With a forward non-GAAP P/E ratio of 16.04, the company trades approximately -29.98% lower than the sector median of 22.90.

What is irrational to me is that this discount exists despite the company showing strong signs of increasing operational efficiency and stabilizing revenue growth, particularly with the introduction of their IAM platform. The company offered a lot of qualitative and quantitative details on the call last night, showing they have potential. I think we will likely see this gap to the sector median start to close, like what we have seen with Zoom.

As growth picks up and operational efficiency continues to improve, I think that the market should start rewarding DocuSign with a higher P/E ratio, aligning it closer to its sector peers.

If DocuSign were to trade at the sector median P/E of 22.90, this would represent an upside potential of approximately 42.77% for shares from current levels. The company has a plan, a large market, an unmet need, and a new management team that’s ready to execute. Seems like all the ingredients are here for a great story.

Risks

To be clear, the new management hires I think were the right move. But at most companies, when new management arrives, they often signal bold decisions (to show how they will be a change agent and to justify their hire). But with boldness comes risk. Bold decisions therefore can influence terrible outcomes.

In a now infamous example of a legacy industry incumbent that brought in new management to help facilitate a new direction, Billionaire investor Bill Ackman brought in Ron Johnson, the former Apple executive to try to help turn around JCPenny in 2012. Unfortunately, his failed attempt to transform JCPenney into an upscale retailer without testing his strategies alienated the company’s traditional customers while failing to attract a new demographic. This actually likely hastened the decline of the Department store chain.

In Johnson’s case, he eliminated discounts & coupons that customers loved, and focused on boutique-style stores.

As a result, the company’s revenue dropped, and Johnson was ousted just 16 months after being hired. It’s a classic example of how bold strategies, if poorly executed, can accelerate a company’s decline rather than reverse it.

In the case of DocuSign, while I think that the risks of bold management are clear, there is a strong reason to believe that the new leadership will succeed. Unlike the JCPenney case, DocuSign’s new team seems to be making calculated decisions backed by strong leadership with experience in scaling businesses. They are also launching a new product that complements their current offerings, as compared to upending current business strategy as Ron Johnson did. This seems to be the right type of bold decision-making and leadership. I am excited.

Bottom Line

Post Q2, I think DocuSign’s strong financial performance reflects their ability to exceed expectations and start to power the way forward to a future where it continues to be the one-stop-shop for digital contract management.

The company’s introduction of their IAM platform and strong leadership changes tells me that they are making the right strategic moves to achieve long-term growth. I think we’re set to see a turnaround that mirrors the bold turnaround efforts at both PayPal and Zoom this year.

Given this, the company is trading at a notable discount compared to the broader sector median, which I think presents a unique opportunity for a strong upside.

I feel confident in their leadership team and innovative product focus to support the stock. I think shares are a strong buy for those willing to embrace the potential turnaround volatility in exchange for long-term gains.