BLACK_FACTORY/iStock via Getty Images

Genesco’s (NYSE:GCO) 2Q25 results were not very out of line with the company’s guidance for the year, with comparable figures improving a little from 1Q25. Still, the market may have been expecting a faster recovery because the stock fell close to 12% on the day after the earnings were released.

The company is still struggling to find the right assortment for its customers as the fashion cycle challenges its main category, vulcanized shoes (brands like Vans and Converse). It resorted to clearance sales, affecting its gross margins. The second half of fiscal 2025 should bring assortment newness to the stores.

The company’s stock now trades at about the same price as in previous articles in March 2024 and June 2024. The valuation is akin to a binary bet, with a very positive outcome in case the economy improves but potential going concern challenges if the economy does not improve. This almost automatically makes the stock unattractive for conservative long-term holders. The bet is on the economy and not on the company, given that Genesco has not shown that it can control the controllable and adapt to the circumstances (mainly by improving assortment).

For the above reasons, I believe Genesco’s stock is still a Hold from a conservative, safety of capital perspective. Some readers might consider it a more attractive speculation, mainly as a leveraged bet on an economic improvement.

2Q24 results

Better comparables: Genesco posted comparables down 2%, with stores down 4% and online sales up 8%. The main losers were the Schuh store chain (down 2%) and Johnston and Murphy (down 5%). The Journeys group posted sales down only 1%.

This represents sequentially better comparables against 5% in 1Q25. However, the company had also posted 2% negative comparables in 2Q24, improving from 5% down in 1Q24, only to deteriorate further afterward. That means the comparable improvement might be a seasonal factor.

Digital boost may not be margin accretive: Digital sales continue to grow (8% in 2Q25 and 6% in 1H25). These sales help prop up total and comparable sales (representing more than 20% of revenues; 8% growth is similar to a 2% improvement in aggregate comparables). However, digital sales are not always margin-enhancing, given that they may be generated with expensive digital advertising. In fact, despite flat sales for 1H25, Schuh’s operating profits decreased to $2 million from $7.5 million last year (the group is the most exposed to digital sales).

Assortment problem: The company’s problem continues to be assortment. On the one hand, the important categories of vulcanized (brands like Vans or Converse) continue to be challenged. On the other hand, the consumer is more mindful of where they are spending their money. Both problems should be addressed from assortment, in one case expanding other categories, in the second one bringing more value or entry priced products.

Genesco has addressed this problem relatively late. For example, this quarter Schuh had to carry clearance sales affecting its gross margins (as commented on the call, the segment margins are not separately disclosed). Genesco brought a new Chief Merchandise Officer in 1Q25 and a new Chief Marketing Officer in 2Q25, so change may be on its way, but this should have happened faster, as the retailer has more leeway to adapt its product assortment than a wholesale brand.

Hope for 3Q25: On the other hand, Genesco’s management commented that both July (belonging to 2Q25) and August (belonging to 3Q25) posted positive comparables YoY. The company is confident that its new merchandise strategy will start to bear fruits in 2H25.

Readers should remember that the second half represents the majority of Genesco’s sales (as it includes the back to school and holidays seasons).

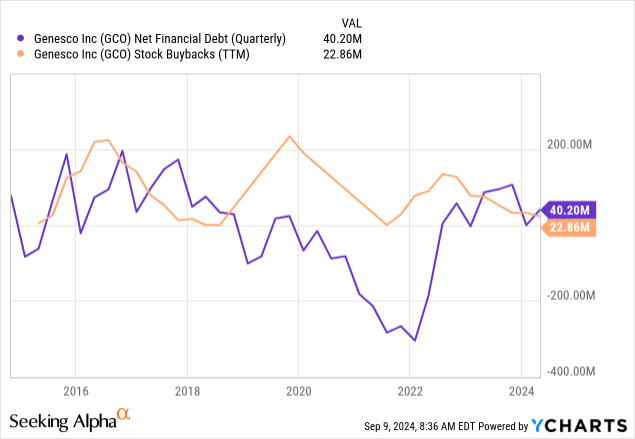

Risky capital allocation: Genesco used close to $10 million in cash to repurchase shares in 2Q25. This may not sound like much, but the company has $77 million in debts against $45 million in cash. Retailers should generally not carry debt, as their business already suffers from operational leverage. With comparables down, proximity to operational losses, and positive net debt, buying back shares does not seem like a priority. It reduces the company’s protection in case the downturn becomes more pronounced.

Valuation is unattractive for long-term holders, attractive for speculation

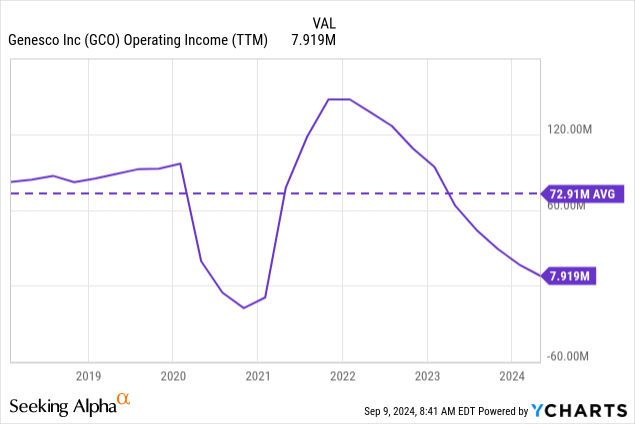

Genesco’s valuation has not changed much since I started writing about the company in March 2024. It still posts a market cap of about $300 million. Against this, the company’s average operating income since 2018, or $73 million, looks incredibly enticing. If Genesco can recover, then its current price is extremely cheap.

The company trades at this valuation because the difference between massive losses and massive profits is very small. The difference between operating income of $94 million in FY23 and operating profits of ‘only’ $15 million in FY24 (adjusted for goodwill impairment) was only 2.5% of sales.

Therefore, Genesco’s stock is similar to a coin flip. Suppose the economy recovers and the company improves its operations simply because of higher traffic and more consumer discretionary income. In that case, the company will generate a lot of operating income compared to its current market cap. However, suppose the economy continues to be challenging, and consumers are more mindful of their expenses. In that case, Genesco may not only not generate sufficient operating income but also suffer liquidity risks, as it does not have significant cash reserves.

The company’s future depends on the economy because it has not yet shown the ability to control what can be controlled. The challenging environment has existed since mid-2022, but the company is only now introducing assortment changes, almost two years later. This speaks of a lack of initiative.

In addition, the company’s assortment transition is necessary but risky. The company is well known for its vulcanized assortment, and as it transitions into other categories, it may find more competition or that it is alienating its core customer base.

In summary, Genesco does not have the basic characteristic of a long-term investment, which is the safety of capital. Already close to operational losses and without cash reserves, the company can only sustain the current negative environment for some time before it reaches financial problems. The current assortment transition is necessary but increases the inventory risks in the short term, putting more pressure on the company’s financials.

As a speculative bet, Genesco may be more interesting to some readers. The stock offers a relatively binary outcome between an improving economy leading to much higher operating profits via operational leverage, or a stagnant or worsening economy putting the company’s viability at stake.

I follow a conservative long-term approach and therefore believe Genesco is still a Hold at current prices.