RiverNorthPhotography

Under CEO Ryan Cohen’s leadership, GameStop Corp. (NYSE:GME) is attempting to turn around the unprofitable merchandise. While I think Ryan Cohen has done a great job reducing costs and improving profitability, the gaming hardware and software retail market is likely to face strong competition from both game publishers and big retailers such as Walmart Inc. (WMT) and Amazon.com, Inc. (AMZN). As a retailer, GameStop is unlikely to successfully turn around their core business in the future, in my view. I am initiating a “Strong Sell” rating with a one-year target price of $14 per share.

Challenging Market For Gaming Distribution

GameStop’s business decline was primarily driven by the challenging retailer market. More specifically, the challenges can be summarized as follows:

- Online Stores Operated by Game Publishers: To maximize profits, game publishers have been investing in their online channels to encourage customers to purchase games directly. For instance, Sony operates the PlayStation Network, where gamers can purchase consoles, games, and accessories directly. Similarly, Microsoft Corporation (MSFT) has Xbox Live and Nintendo owns Nintendo Switch Online. With these online stores, there is little value proposition for physical retailers. In addition, Amazon and Walmart have been expanding their distribution network for gaming hardware and software, which has further challenged the physical retail business.

- In the future, gamers will be able to download individual virtual reality games directly onto their virtual reality hardware, such as headsets or glasses. With the rising popularity of virtual reality, physical retailers for computer games will become increasingly irrelevant.

As such, I don’t anticipate GameStop can turn around their core business in the future, and the company is more likely to enter a virtuous cycle: declining revenue, store closures, and fewer customers.

Leadership Under Ryan Cohen

Ryan Cohen, the former activist and CEO of Chewy, Inc. (CHWY), took a 12% position at GameStop and became CEO in September 2023. I gave him credits for the following:

- Since taking the helm, he has tried to reduce costs and improve cash flow and profitability. He recognized that many employees and leaders were making little effort to save the company and were simply waiting for retirement. He removed most of the senior management team at the end. The SG&A cost as a percentage of total revenue has been reduced from 28.4% in FY22 to 25.1% in FY23. I think it is essential for GameStop to stop the financial bleeding first.

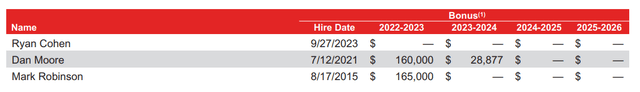

- Ryan Cohen takes no salary, no bonus and other incentives at GameStop, demonstrating his full commitment to turning the company around.

GameStop 2023 Proxy GameStop 2023 Proxy

- Ryan Cohen is trying to focus on game resell business, Omnichannel, as well as game accessories. He terminated GameStop’s NFT marketplace in February 2024 and decided to shut down the cryptocurrency wallet. I would be very concerned if GameStop became involved in any cryptocurrency-related business, given the increasing regulatory uncertainties. After all, GameStop is a physical retailer company, not a high-tech enterprise.

I think these initiatives above make strategic sense in attempting to turn around the business. However, the question remains: how can GameStop start growing their business in the future? The revenue will be likely to decline over time, and the best the management can do is to reduce costs to improve margins. Cost reduction cannot be realized indefinitely, and eventually, GameStop will need topline growth/stability to generate profitability.

Last December, GameStop’s Board of Directors approved a new investment policy, allowing the company to invest in equity securities, among other investments. The Board of Directors designated Ryan Cohen with the authority to manage the investment portfolio. In other words, GameStop seems more likely to turn into an investment company, with Ryan Cohen as the portfolio manager. I think Ryan Cohen may be attempting to replicate his success with his investment company, RC Ventures LLC. However, I don’t think it makes sense for a retailer to transform into an investment company.

Capital and Liquidity

GameStop exited their Q2 FY24 with $4.204 billion in cash and cash equivalents. GameStop took the advantage of high stock price to issue equities:

- On May 17th, 2024, GameStop issued 45 million shares for $933.4 million.

- On June 11th, 2024, GameStop issued its 75 million shares for $2.137 billion.

In addition, due to bankruptcy concerns, suppliers have been tightening their credit standards with GameStop. Notably, GameStop’s account payable has caused $398 million cash outflow, indicating GameStop has to pay their suppliers in a shorter timeframe.

On the positive side, the free cash flow position is likely to improve over time as the company continues actively controlling their operating expenses. GameStop generated $68.6 million in operating cash flow in Q2 FY24, a big improvement from the $109 million outflow in Q2 FY23.

Additionally, GameStop is closing some unprofitable stores, with 287 store closures in FY23. The store closures could help the company reduce their capital expenditures in the near future. As such, I don’t think GameStop is going to face any capital liquidity issues anytime soon. Their current cash balance of $4.204 billion and free cash flow should be sufficient for their working capital and capital expenditures over the coming years.

Recent Result, Outlook, and Valuation

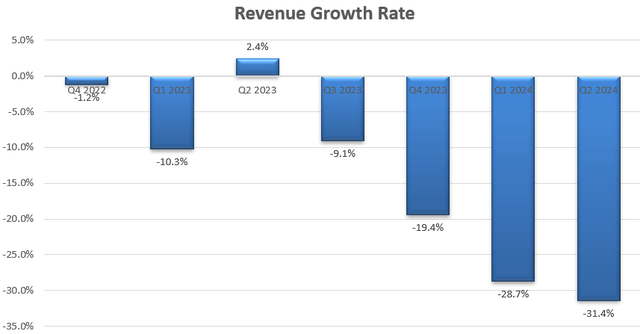

GameStop released its Q2 result on September 10th after the market close, reporting a 31.4% year-over-year decline in total revenue, as depicted in the chart below. The quarterly result reflects a further deterioration of GameStop’s core business.

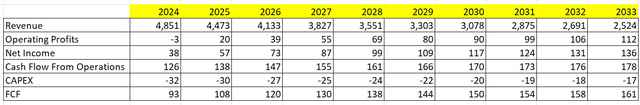

I am considering the following factors for GameStop’s near-term growth:

- I anticipate will continue closing their unprofitable stores. Bed Bath & Beyond faces similar growth issues, with a structural decline in a challenging physical retail market. Bed Bath & Beyond has been closing their stores over the past few years, now operating around 1,000 stores. At the end of FY23, GameStop operated 4,169 stores in total. Assuming the company will close 200 stores per year, it would take around 15 years to reduce to approximately 1,100 stores. I calculate that the store closure will negatively impact total revenue growth by 5%-6% in the near future.

- As discussed previously, Ryan Cohen has been shifting the corporate strategy towards used games, omnichannel and game accessories. However, GameStop is facing significant challenges in the rising competition from game developers as well as big retailers. As such, I don’t think Ryan Cohen’s strategy can help GameStop generate positive same-store sales growth. I assume GameStop’s same-store sales will decline by 3% annually.

- GameStop’s margin improvement will be driven by several factors. These include the closure of unprofitable stores, which will improve the overall operating margin for physical locations, and Ryan Cohen’s efforts to control SG&A expenses by reducing middle management and consolidating some nonfunctional divisions. I calculate GameStop will achieve 50bps annual margin expansion, assuming 20bps from store closures and 30bps from SG&A optimization.

With these parameters, the DCF can be summarized as follows:

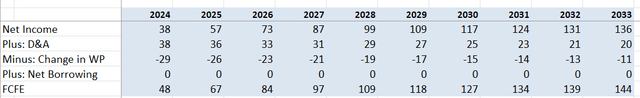

I calculate the free cash flow from equity (FCFE) as follows:

The cost of equity is estimated to be 16% assuming: risk free rate 3.8%; equity risk premium 7%; beta 1.88.

Discounting all the FCFE, the one-year target price is calculated to be $14 per share.

Key Upside Risks

As I assign a “Sell” rating, I am considering the upside risks as follows:

- GameStop is a meme stock with a large base of individual investors. These investors may accumulate a certain size of Buy orders to trigger a short squeeze for short sellers. It has already happened in the past, and it is possible to happen again in the future.

- Ryan Cohen has been quite successful with his investment firm, RC Ventures LLC. As the Board of Directors has already authorized him the power to invest in a broad range of investments, he might be able to make some profitable investments, whether in public equity or private equity. In that case, GameStop might become profitable through these investments.

- Lastly, Ryan Cohen could turn GameStop into a private company by purchasing shares at a premium from existing shareholders. In that scenario, the stock price might move higher in the future.

End Notes

I think GameStop’s core retail business will continue to face structural challenges from game developers and big retailers. It seems more likely that Ryan Cohen will steer GameStop toward becoming an investment company, as a turnaround of their core business appears impossible. I am initiating a “Strong Sell” rating for GameStop Corp. stock with a one-year target price of $14 per share.