JamesBrey

Who likes high yield?

I’m not talking about the so-called “sucker yield” stocks likes those I referenced in a recent article:

I’m talking about high-yielding stocks that are not likely to erode shareholder value.

It’s true that some of the best small-cap stocks can be found “flying under the radar”.

However, in order to find these so-called “diamonds in the rough” it requires vigorous research.

So, in this article, I will highlight three small cap REITs that are poised to deliver solid total returns from dividends and capital appreciation.

CTO Realty Growth (CTO)

This company is a Florida-based real estate company that has evolved over the years from primarily generating income from timberland, mineral, & subsurface rights, to becoming the diversified REIT it is today with income producing retail assets located across 8 states.

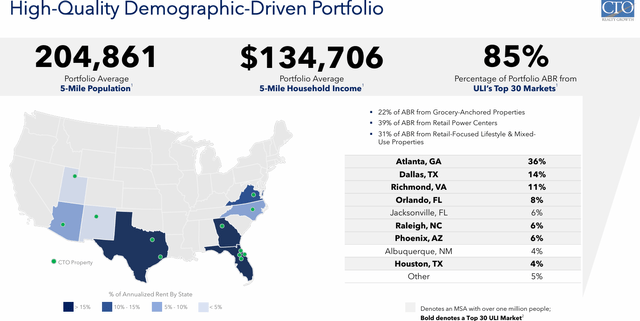

CTO has a market cap of approximately $443.2 million and a 3.9 million SF portfolio made up of 20 properties that were 93% occupied and generated $81.1 million of annualized base rent (“ABR”) in 2024.

The company stresses the importance of business-friendly markets and targets markets with local governments that support business with limited regulations and lower taxes. CTO feels it can produce outsized long-term growth in these markets where free-market capitalism is more heavily employed.

Consequently, many of CTO’s properties are located in the Southeast and Southwest regions of the country. Based on ABR, the company’s largest market is Atlanta which made up 36% of its portfolio followed by Dallas and Richmond which made up 14% and 11%, respectively.

CTO has a particularly strong presence in Georgia, Texas, and Florida and receives roughly 71% of its ABR from these 3 states alone.

The company primarily invests in multi-tenanted retail assets with a grocery or lifestyle component as well as a complimentary mixed-use component. Additionally, the company invests in single-tenant net lease retail properties.

As of its most recent update, 96% of the company’s ABR was generated from retail & mixed-use properties and 22% came from grocery-anchored properties.

In addition to its primary property types, the company invests in ground leases, secured commercial loans, and real estate related securities such as mortgage-backed securities, corporate bonds, common or preferred stock.

CTO also has a material investment in Alpine Income Property Trust (PINE), which is a pure-play net lease REIT that CTO seeded and now externally manages. At the end of 2023, CTO’s investment totaled nearly $40 million, or 15.7% of PINE’s outstanding shares. CTO receives dividend income from PINE and can possibly benefit from capital appreciation.

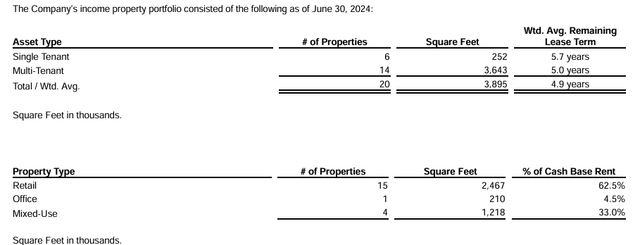

At the end of the second quarter, the company’s portfolio totaled 20 properties, including 14 multi-tenant and 6 single tenant properties with a weighted average lease term of 4.9 years.

15 of the properties are retail, total 2.5 million SF, and made up 62.5% of CTO’s second quarter cash rent.

4 of the properties are mixed-use, total 1.2 million SF, and made up 33.0% of the company’s 2Q-24 cash rent.

CTO’s portfolio includes 1 office property that totals 210,000 square feet and makes up 4.5% of its rent.

CTO recently released its 2Q-24 operating results and reported total revenue during the quarter of $28.8 million, compared to total revenue of $26.0 million in the second quarter of 2023.

Core FFO during the quarter was reported at $10.4 million, or $0.45 per share, compared to Core FFO of $9.6 million, or $0.43 per share in the second quarter of 2023. The year-over-year change in Core FFO represents a 7.8% increase, or 4.7% increase on a per share basis.

Adjusted FFO, or AFFO, was reported at $11.1 million, or $0.48 per share during 2Q-24, compared to AFFO of $10.8 million, or $0.48 per share in 2Q-23.

During 2Q-24 the company signed 16 leases totaling nearly 79,000 SF. On a comparable basis, its same store leasing activity included 11 leases totaling almost 59,000 SF with cash leasing spreads of 8.8%.

The company reported a net debt to pro forma EBITDA of 7.5x and a fixed charge coverage ratio of 2.7x. At the end of the second quarter, CTO’s long-term debt had a W.A. interest rate of 4.23% and the company reported total liquidity of $154.8 million.

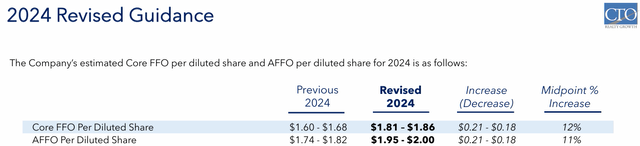

Finally, the company raised its 2024 Core FFO and AFFO guidance. The revised guidance for Core FFO is between $1.81- $1.86 which represents an increase of 12% at the midpoint. AFFO was revised to range between $1.95 and $2.00 per share, which is an increase of 11% at the midpoint.

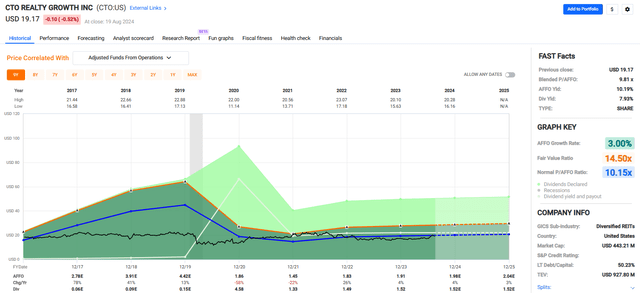

CTO Realty Growth has had an average AFFO growth rate of 3.00% since 2017. However, the company just recently converted to a REIT in 2020 so the changes in its AFFO and dividends are somewhat skewed with AFFO increasing 78%, 41%, and 13% prior to the conversion.

Similarly, it appears that a special dividend was paid in 2020, likely in connection with its conversion, so a better baseline for dividend growth would start in 2021.

Analysts expect AFFO per share to increase by 4% in 2024 and then by 3% the following year, and I would expect AFFO and dividend growth to remain in line with average growth of 3-4%.

Currently, the stock pays a 7.93% dividend yield that is well covered with a 2023 AFFO payout ratio of 79.58%. The stock is currently trading at a blended P/AFFO of 9.81x which is a discount to its normal AFFO multiple of 10.15x, and a considerable discount to where many other Sunbelt retail REITs trade at. A few Sunbelt retail REITs include:

- InvenTrust Properties (IVT) – blended AFFO multiple: 20.27x

- Kite Realty Group (KRG) – blended AFFO multiple: 17.82x

- Kimco Realty (KIM) – blended AFFO multiple: 18.40x

- Whitestone REIT (WSR) – blended AFFO multiple: 17.78x.

This compares to CTO Realty Growth that primarily owns multi or single-tenant retail properties in the Sunbelt and trades under of multiple of 10x.

CTO is much smaller and is not a pure-play shopping center REIT, so some discounting is warranted, but 7 to 10 turns is a bit excessive.

We rate CTO Realty Growth a Buy.

Alpine Income Property Trust (PINE)

PINE is a net lease REIT that is externally managed by CTO Realty Growth.

Before its public listing in 2019, the company was a unit of Consolidated-Tomoka Land Co., which would later be renamed to CTO Realty Growth.

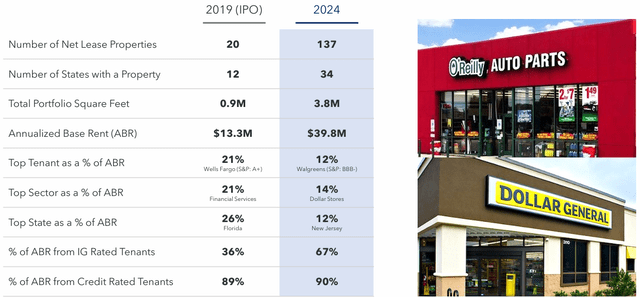

Alpine’s original portfolio consisted of 20 properties it purchased from CTO with proceeds from its IPO in 2019.

As of its most recent update, the company’s portfolio now comprises 137 net lease properties totaling 3.8 million SF across 34 states.

PINE’s entire portfolio is made up of net lease retail properties. Since 2019 the company increased its footprint from 12 to 34 states, its portfolio square footage from 0.9 million to 3.8 million, and its portfolio ABR from $13.3 million to $39.8 million as of 2Q-24.

The company’s top tenant exposure improved from 21% to 12%; however, its top tenant is Walgreens (WBA), which is currently looking to close some of its stores.

More on this later, but generally speaking, tenant diversity has improved since the company’s IPO. Similarly, the company’s exposure to any one retail sector or any one state has improved since 2019.

One thing I really want to point out is the percentage of rent PINE derives from investment grade tenants. It improved from 36% in 2019 to 67% in 2024. Alpine derives 67% of its ABR from IG tenants, which is up there with the likes of Agree Realty (ADC).

At the end of the second quarter, PINE reported a current occupancy of 99.1% and a weighted average lease term (“WALT”) of 6.6 years.

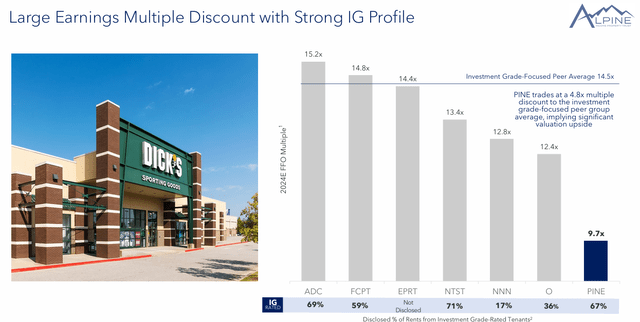

PINE compares well against many of its net lease peers on several fronts. As just mentioned, the company receives nearly 70% of its annual rent from investment grade tenants. That’s in the same league as NETSTREIT Corp (NTST) at 71% and Agree Realty (ADC) at 69%.

While PINE’s rent from IG tenants is roughly on par with ADC and NTST, it trades at a far lower multiple. The graph below uses the closing prices from June 30, 2024, which is outdated, but still makes the point.

At the end of the second quarter, PINE traded at a 9.7x FFO multiple, compared to ADC which traded at a multiple of 15.2x and NTST which traded at a multiple of 13.4x.

Using current prices, we get the same general result. PINE trades at a 10.76x FFO multiple, ADC trades at a 17.68x, and NTST trades at a 13.39x FFO multiple.

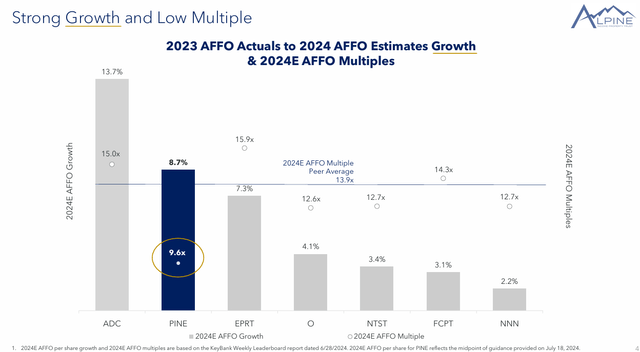

PINE also compares favorably to its peers as it relates to AFFO growth and price. PINE is expected to grow AFFO per share by almost 9% in 2024 which leads all net lease peers listed below except Agree Realty which comes in first with expected AFFO growth of 13.7%.

While PINE is expected to achieve higher 2024 AFFO growth than all but one of the listed peers, it has the lowest AFFO multiple at 9.6x, compared to:

- Agree Realty (ADC) 24E AFFO Multiple: 15.0x

- Essential Properties Realty Trust (EPRT) 24E AFFO Multiple: 15.9x

- Realty Income (O) 24E AFFO Multiple: 12.6x

- NETSTREIT (NTST) 24E AFFO Multiple: 12.7x

- Four Corners Property Trust (FCPT) 24E AFFO Multiple: 14.3x

- NNN REIT (NNN) 24E AFFO Multiple: 12.7x

Again, the numbers below are not current, but make the point. PINE’s higher growth does not appear to be reflected in its multiple.

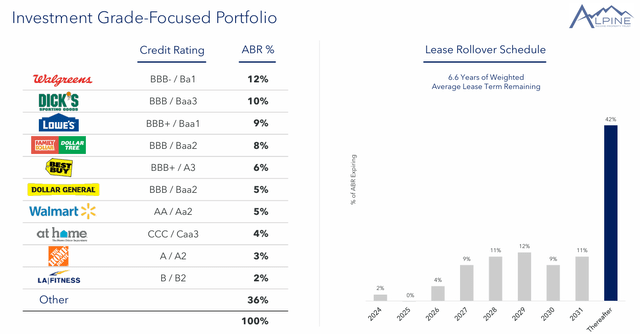

While there is a lot to like about PINE’s top tenants, one negative aspect is the company’s concentration / exposure to Walgreens. As previously mentioned, WBA is currently closing stores and exploring further options to improve the company’s position.

As a landlord, you never want to hear your top tenant is closing stores. Unfortunately, PINE will likely be dealing with this over the next several years since its top tenant is Walgreens and makes up 12% of the company’s ABR.

Walgreens has not given exact numbers that I’m aware of, but it has indicated that a “meaningful percent” of the underperforming stores would be shuttered over its multi-year program.

In PINE’s latest earnings call, John Albright, President and CEO mentioned that the company was paring down its Walgreens exposure and that they currently have 2 stores in the sales process.

When asked about Walgreens lease expiration schedule, Mr. Albright stated the weighted average lease length for WBA was approximately 8 years. This is good news and should give PINE plenty of time to sell the properties at reasonable prices.

While the headline looks bad, I don’t see this being too much of an issue over the long term. Walgreens is an investment grade rated company (BBB-) with a market cap of $9.2 billion and has plenty of resources to see it through the current challenges.

Plus, only 2% of Alpine’s ABR expires in 2024, none expires in 2025, and only 4% expires in 2026. The company’s lease rollover schedule, combined with Walgreen’s WALT of ~8 years, and the financial strength and credit of the tenant should mitigate the damage as much as can be expected.

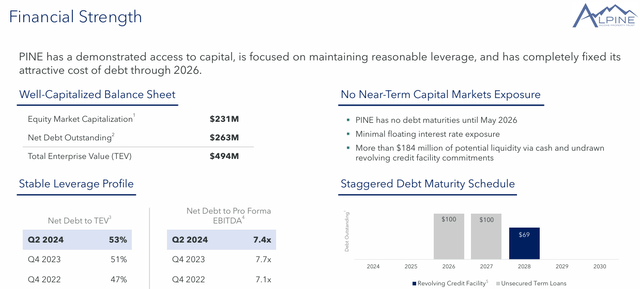

PINE is not IG rated, but it has reasonable debt metrics with a net debt to total enterprise value (“TEV”) ratio of 53%, a net debt to pro forma EBITDA of 7.4x, and an interest expense to EBITDA ratio of 3.10x.

Plus, the company has minimal floating interest rate exposure and no debt maturities until May 2026.

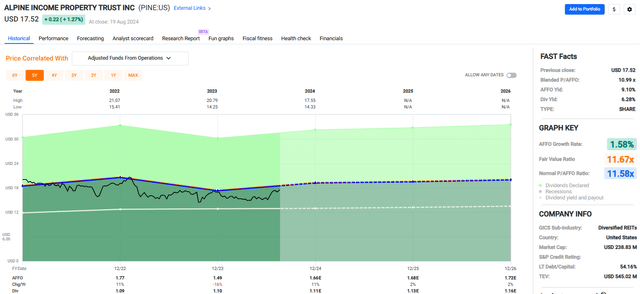

Over the past several years, PINE has had an average AFFO growth rate of 1.58%. Analysts expect AFFO growth of 11% in 2024, but then expect growth to moderate, with AFFO projected to increase by 2% in both 2025 and 2026.

Currently, PINE pays a 6.28% dividend yield and trades at a P/AFFO of 10.99x, compared to its average AFFO multiple of 11.58x.

While PINE trades at a discount compared to its net lease peers, the company should trade at some discount given its size with a market cap of approximately $237.9 million, its short public history, and the fact that it is externally managed.

I should mention that there is high alignment between PINE and its external manager since CTO owns around 16% of Alpine. However, the company is still externally managed and very small, so some discount is warranted.

We rate Alpine Income Property Trust a Buy.

Broadstone Net Lease (BNL)

BNL is a net lease REIT that specializes in the acquisition and management of single-tenant commercial properties that are leased to operators across multiple property types including industrial, restaurants, healthcare, retail, and office.

The company was formed in 2007 and currently has a market capitalization of approximately $3.5 billion. BNL’s portfolio consists of 777 properties that are located in 44 states and 4 Canadian provinces.

At the end of 2Q-24, the company’s portfolio was 99.3% leased with 207 tenants and a WALT of 10.4 years with average annual escalations of 2.0%. Plus, 94.8% of its portfolio provided financial reporting.

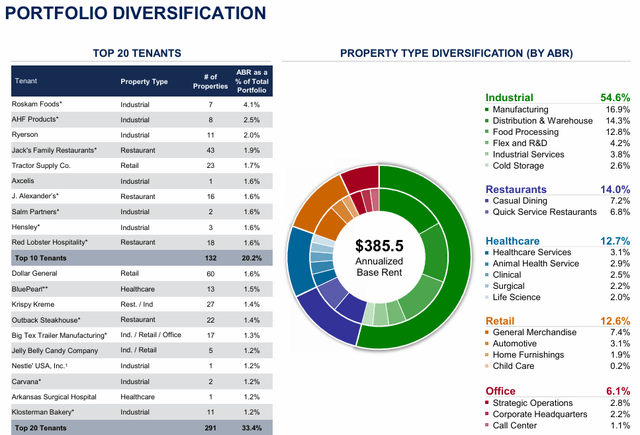

Broadstone has a very diversified portfolio by property type. Its largest property type is industrial which represents 54.6% of its portfolio, followed by restaurants which makes up 14.0%, healthcare which contributes 12.7%, and retail and office that make up 12.6% and 6.1%, respectively.

The company provides a nice breakdown of its sub-property types within each category. BNL’s industrial properties are used in manufacturing, distribution, cold storage, and food processing.

The restaurants in BNL’s portfolio include both casual dining and quick service and its healthcare properties are used for healthcare services, animal health services, clinical and surgical services.

The company’s retail properties consist of general merchandise, automotive, and home furnishings, while its office properties include strategic operations, call centers, and corporate headquarters.

Broadstone recently released its 2Q-24 operating results and reported total revenue during the quarter of $105.9 million, compared to total revenue of $109.4 million in the second quarter of 2023.

Core FFO during the quarter was reported at $73.0 million, or $0.37 per share, compared to Core FFO of $74.4 million, or $0.38 per share in 2Q-24.

AFFO in 2Q-24 came in at $70.4 million, or $0.36 per share, compared to AFFO of $69.0 million, or $0.35 per share in the second quarter of 2023.

During 2Q-24, the company invested $165.1 million in new acquisitions at a W.A. initial cap rate of 7.3%. The second quarter acquisitions have an average lease term of 11.5 years with a W.A. annual rent increases of 2.3%.

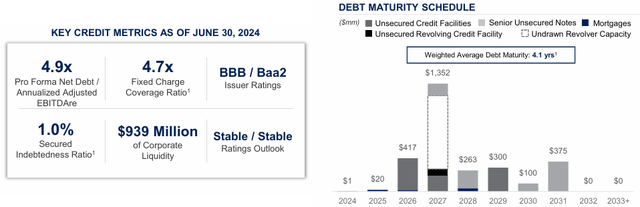

At the end of 2Q-24, the company had $1.9 billion of outstanding debt, a net debt to adjusted EBITDAre ratio of 5.1x, and a fixed charge coverage ratio of 4.7x.

BNL has an investment grade balance sheet with a BBB credit rating from S&P Global. The company’s debt has a W.A. term remaining of 4.1 years and it has no significant debt maturities until 2026.

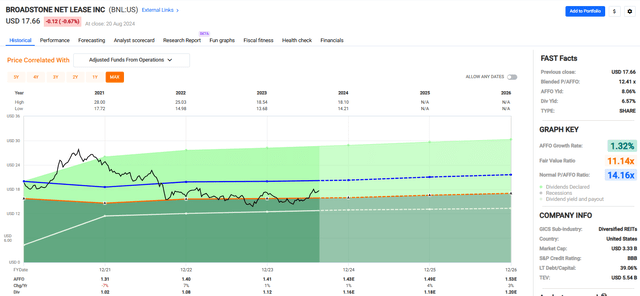

Since 2021 BNL has had an average AFFO growth rate of 1.32%. Analysts expect AFFO per share to increase by 1% in 2024 and then increase by 4% and 3% in the years 2025 and 2026, respectively.

BNL pays a 6.57% dividend yield that is well covered with a 2023 AFFO payout ratio of 79.43% and the stock is currently trading at a P/AFFO of 12.41x, compared to its normal AFFO multiple of 14.16x.

Broadstone is a net lease REIT that pays a high dividend yield and has an investment grade balance sheet. Some of its net lease peers with an investment grade credit rating trade at higher multiples including:

- Realty Income (O), credit rating: A-, AFFO multiple: 14.67x.

- Agree Realty (ADC), credit rating: BBB+, AFFO multiple: 17.73x.

- VICI Properties (VICI), credit rating: BBB-, AFFO multiple: 14.41x.

While BNL is not as established or as well-known as the 3 net lease REITs listed above, the company is investment grade and has a ton of industrial exposure in its portfolio.

We rate Broadstone Net Lease a Buy.

In Closing

CTO Realty, Alpine Net Lease, and Broadstone Net Lease are all higher yielding REITs that should deliver steady dividends and growth.

Although not as solid fundamentally as some of the blue-chip names we normally recommend, we like the risk-reward setup.

As REITs continue to rally (and rates decline in September), we will continue to provide readers with more actionable ideas like these.

Thank you for reading and commenting.

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed to assist in research while providing a forum for second-level thinking.