IT security solutions provider CyberArk Software (CYBR – Free Report) has become a notable standout in the tech sector after exceeding third quarter expectations on Wednesday.

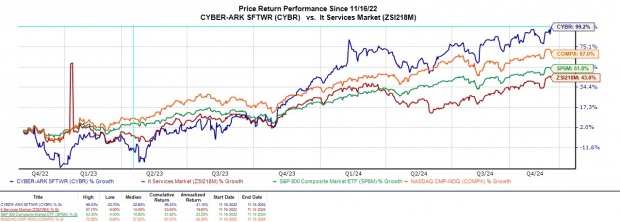

Hitting all-time highs of $318 a share this week, CyberArk’s stock has now rallied nearly +40% year to date and currently covets a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

CyberArk’s Strong Q3 Results

Reporting strong Q3 results, CyberArk CEO Matt Cohen stated the company’s industry leadership in identity security helped deliver strong net new annual recurring revenue (ARR), record revenue, increased profitability, and cash flow.

Record Revenue

CyberArk posted record quarterly sales of $240.1 million, topping Zacks estimates of $233.9 million and soaring 25% from $191.24 million a year ago.

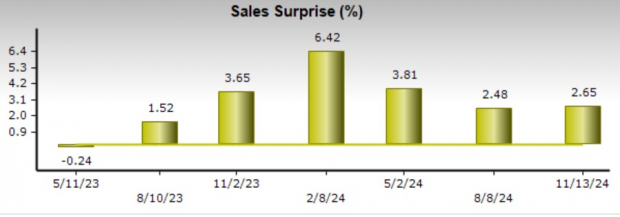

Optimistically, Total ARR spiked 31% year over year to $926 million. CyberArk has surpassed top line estimates for six consecutive quarters posting an average sales surprise of 3.84% in its last four quarterly reports.

Image Source: Zacks Investment Research

Increased Profitability

Most compelling is that CyberArk also achieved a quarterly record for adjusted earnings per share with Q4 EPS soaring 124% to $0.94 compared to $0.42 a share in the comparative quarter. Even better, this crushed the Zacks EPS Consensus of $0.45 by 109%.

CyberArk has reached or exceeded earnings expectations for 13 consecutive quarters posting a very impressive average EPS surprise of 97.68% in the last four quarters.

Image Source: Zacks Investment Research

Cash Flow

Free cash flow stretched to $51.56 million from $13.62 million in Q3 2023. Able to strengthen its balance sheet, CyberArk’s cash & equivalents have ballooned to $1.23 billion with the company coming into the year with $355.93 million.

CyberArk’s Revenue Guidance

For Q4, CyberArk expects revenue in the range of $297 million-$303 million, representing growth of 33%-36%. CyberArk expects full-year fiscal 2024 revenue to increase by 31%-32% to $983 million-$989 million.

EPS Growth & Revisions

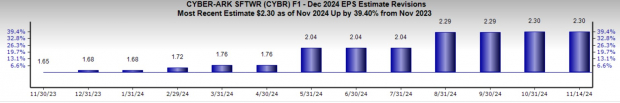

Based on Zacks estimates, CyberArk’s annual EPS is now expected to expand 105% in FY24 to $2.30 versus $1.12 in 2023. Plus, FY25 EPS is projected to increase another 45% to $3.35 per share. Leading to CyberArk’s strong buy rating and its brilliant price performance this year has been a compelling trend of earnings estimate revisions for FY24 as shown below.

Image Source: Zacks Investment Research

Bottom Line

CyberArk is one of the most intriguing tech stocks to watch at the moment and it would be no surprise if CYBR keeps drifting higher as earnings estimate revisions are likely to rise in the coming weeks.