Images By Tang Ming Tung

The numbers for U.S. stock market dividends took a distinctly bearish direction in August 2024.

We can see that in the form of a single number, which is simply the net year-over-year change in the number of favorable and unfavorable dividend actions. Favorable changes include things like dividend increases, resumptions of dividends after having been suspended, and also special or extra dividend payments for shareholders. Unfavorable changes include dividend decreases and omitted (or passed) dividends.

August 2024 saw the positive development of fewer unfavorable actions, with four fewer dividend reductions or omissions that took place in August 2023. That positive, however, was more than offset by the negative change in the number of favorable dividend actions, as thirty fewer companies declared they would boost dividend payments to their shareholders than did a year earlier. That makes -24 the single overall net number that describes August 2024’s dividend actions.

That negative number continues an ongoing bearish trend for dividend payers in the U.S. stock market over much of the past year. The numbers behind our single number describing the trend for U.S. stock market dividends are presented in the following table, which gives the number of dividend declarations, announced increases, decreases, resumptions, omissions, and special (or extra) dividend payments for August 2024, showing how they changed month-over-month from July 2024 and how they changed year-over-year from August 2023.

| Dividend Changes in August 2024 | |||||

|---|---|---|---|---|---|

| Aug-2024 | Jul-2024 | MoM | Aug-2023 | YoY | |

| Total Declarations | 4,105 | 3,882 | 223 ▲ | 4,465 | -360 ▼ |

| Favorable | 188 | 156 | 32 ▲ | 218 | -30 ▼ |

| – Increases | 119 | 116 | 3 ▲ | 134 | -15 ▼ |

| – Special/Extra | 67 | 39 | 28 ▲ | 81 | -14 ▼ |

| – Resumed | 2 | 1 | 1 ▲ | 3 | -1 ▼ |

| Unfavorable | 13 | 5 | 8 ▲ | 17 | -4 ▼ |

| – Decreases | 13 | 5 | 8 ▲ | 15 | -2 ▼ |

| – Omitted/Passed | 0 | 0 | 0 ◀▶ | 2 | -2 ▼ |

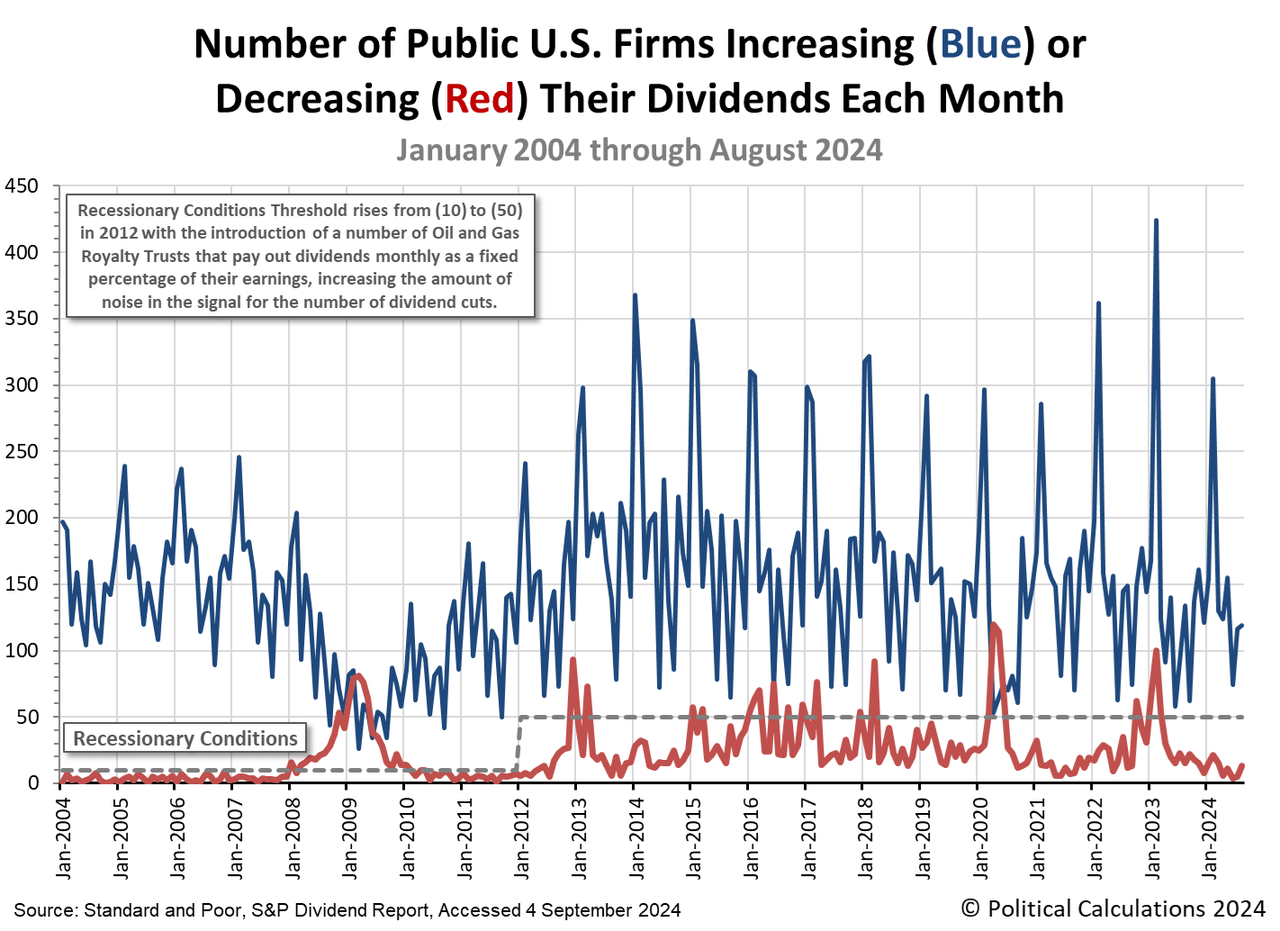

While the net trend is negative, the overall level of dividend increases and decreases are still removed from the levels that would confirm the arrival of recessionary conditions in the U.S. economy. The following chart visualizes the monthly counts of dividend increases and decreases from January 2004 through August 2024.

August 2024 reverses the small positive net change recorded in July 2024 and resumes the negative trend we’ve seen develop in the data since 2023.

We sampled dividend decreases announced during August 2024, finding most were declared by firms that pay variable dividends in the oil and gas sector, which makes sense since oil prices have been falling during the past two months. Despite that, we find the number of these dividend decreasing firms remains well below the threshold we associate with recessionary conditions in the oil and gas industry.

The unanswered big money question is, how long might that continue if the bearish trend for dividends continues?

References

Standard & Poor’s. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 4 September 2024.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.