da-kuk

Introduction

Verint Systems (NASDAQ:VRNT) just recently reported its Q2 ’25 results, so I wanted to look at the company’s overall performance over the years to see if it would be a good time to start a position. I am not very impressed with how the financials progressed over the years, and the reliance on adjusted numbers makes it for risky investment at this price. I am initiating a hold rating.

Q2 Results

Revenues came in at $210m, flat y/y. GAAP EPS came in at $0.2 vs -$0.17 from a year ago, showing efficiency improvements.

AI Bookings came in at over 40% y/y as the strong momentum continues. Bundled SaaS revenue growth also accelerated to 15% y/y, which was driven by AI. Non-recurring revenue continues to decline, which was expected but will continue to be a drag on the company’s top-line performance.

On the margins side, gross margins saw a 150bps improvement y/y.

Overall, because of the drag of the non-recurring segment, the top line coming in flat is not impressive. Strong AI momentum is good to see but to offset the drag, it needs to continue going that way or accelerate.

It seems that the market did not like the initial results. The stock price is down around 10% post-market.

Financials

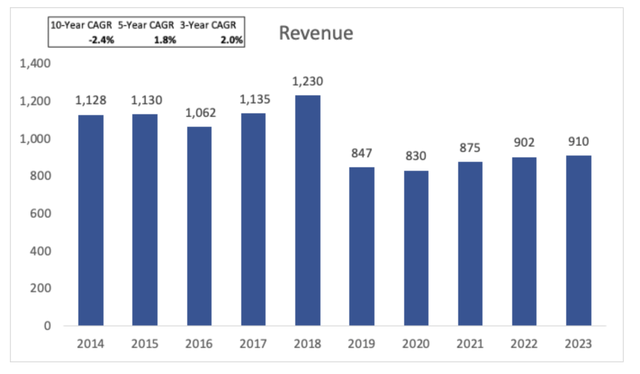

Let’s start from the top. The company’s revenues did not perform very well over the last decade. Since the separation in 2019, the company saw its revenue grow at a 1.8% 5-year CAR. The company’s 3-year CAGR also came in at around 2%, which is not very impressive.

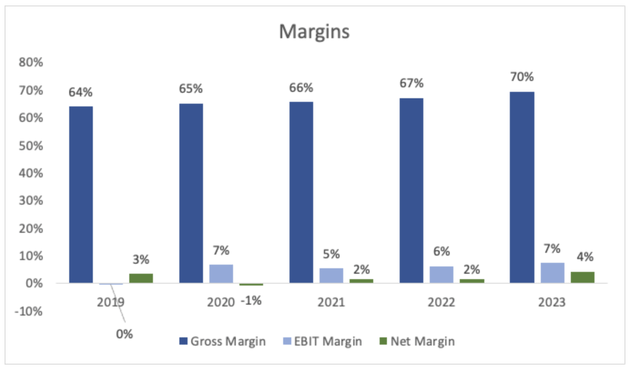

In terms of efficiency and profitability (GAAP), the company’s gross margins are very healthy and have been steadily increasing, however, none of that efficiency trickled down, as EBIT and net margins have been very low over the last while.

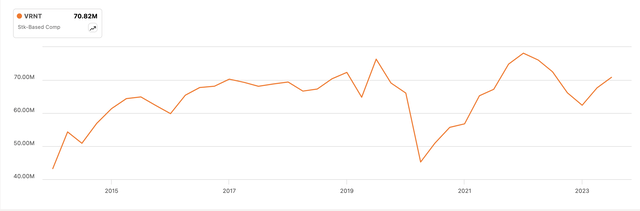

So, what is causing such a deviation from GAAP-established requirements? The usual culprit of stock-based compensation, or SBC for short. The company expects to continue to rely on SBC for the foreseeable future and will pay out anywhere between $74m to $78m in SBC for FY24. That is a massive deviation from the company’s GAAP metrics. Just this past quarter, GAAP EPS came in at $0.13 while non-GAAP EPS came in at $0.53. It is a great tool for new companies to attract and retain talent if the company doesn’t have strong cash flow to support its operations, however, for shareholders, such large SBC numbers are a bit concerning. Dilution of shares is a valid concern when there is so much SBC involved as well as misalignment of incentives, which favor short-term gain in share price over the long-term health of the company. This may lead to risky decisions that may not be beneficial for the long-term investor. As I mentioned, it doesn’t look like the company is putting the brakes on SBC any time soon.

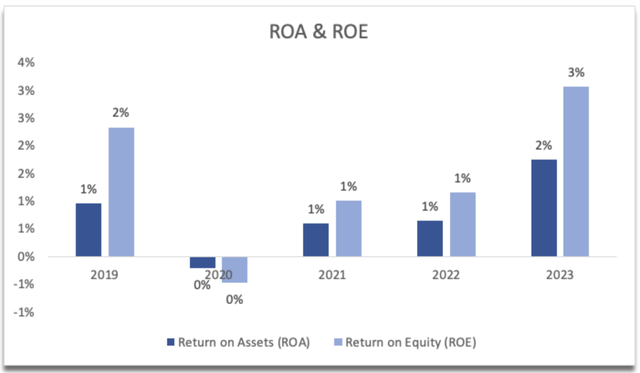

Moving on, the company’s other efficiency and profitability metrics that are important to me, the ROA and ROE are nothing to write home about. I usually look for at least 5% for ROA and 10% for ROE. Here we can see that VRNT’s numbers are well below those minimums. So, what does that mean? It tells that the management is not doing a good job at utilizing the company’s assets and shareholder capital.

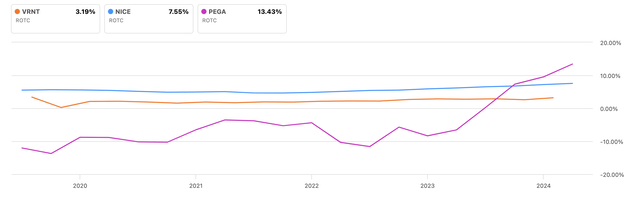

Furthermore, the company’s return on total capital is also quite low, suggesting VRNT may not have any competitive advantage or a strong moat in the industry. I typically consider any company that achieves over 10% to have some sort of moat. So, VRNT’s 3% is well below my minimum. It could be just the industry it belongs to, which could be almost considered like a commodity and no player has a significant advantage over the other. Unfortunately, there aren’t many companies that are publicly traded and are of similar size to VRNT. The company’s 10-K filings show a couple of them, which include Microsoft (MSFT), so there is a lot of competition from that one company alone, I went ahead and compared the ROTCs (without MSFT) of its other peers mentioned. We can see that VRNT is occupying the last place here. That may be because other companies are much bigger than them, which means they have more resources to get ahead, or it could mean that the management of VRNT isn’t doing a particularly good job of running the company efficiently and profitably.

In terms of the company’s overall financial health, as of Q2 ’24, VRNT had around $201m in cash and equivalents, against around $411m in long-term debt. Is this a bad position to be in? I would say no. The company’s operating income came in at around $13.8m for the quarter, while it paid out around $2.5m in interest expenses, which translates to around a 5x interest coverage ratio. Anything over 5x, I consider to be healthy and at no risk of insolvency. Many analysts even consider 2x to be sufficient, but I think it’s a bit too close for comfort.

Overall, I am not impressed with the company’s top-line and margin performance when looking at the GAAP estimates. I am not a big fan of adjusted numbers and that companies rely so heavily on them to report the “true value” of the company. If the difference wasn’t as noticeable, I wouldn’t mind too much, but in the case of VRNT, it is massive; therefore, I will be adding quite a bit of margin of safety to account for it.

Comments on the Outlook

I think the biggest question is what catalyst the company has that will propel its top-line growth considerably going forward. With non-recurring revenues continuing their downward momentum to what I can only assume will become zero in the matter of a couple of years, the company’s recurring, subscription-based model needs to show a decent improvement going forward. In Q1, the growth came in at around 4%, so not great, but that doesn’t mean it is going to continue to do so.

The company’s biggest potential catalyst and the thing that the management is pushing going forward is AI chatbots. There is a lot of potential for this technology to perform well in the future. Right now, it is still in its infancy, as with a lot of the Gen-AI applications out there, so it will take a while to catch on. Access to a customer service representative 24/7 is exactly what every enterprise looks for, and if an AI chatbot can fulfill the same duties as a real human, or even go beyond, will be very beneficial to the enterprise and its customers if the experience is satisfactory.

According to Zendesk, 72% of business leaders will be looking to expand AI and chatbots across CX over the next year, which bodes well for companies like Verint, but is the company going to be able to take advantage of the surge in demand for such technology? It all comes down to the competitiveness of the product it offers. There is a lot of competition in the field for this specific product, so this may mean low margins to gain market share and very capital-intensive R&D to keep up with advancements and to stay on top of the game to thrive and be the market leader. Verint is competing with the likes of IBM’s (IBM) Watson AI platform, and many other similar companies like Markovate, LeewayHertz, and Avaamo, as well as Microsoft’s Azure Bot Service and Google’s (GOOGL) Dialogflow.

MSFT and GOOGL have billions in resources at their disposal, so in order to beat out such stiff competition, Verint’s product must be spectacular. So far, from looking at the growth numbers, I’m not seeing that coming through just yet. Maybe it is still in the early stages, but with many enterprises turning to AI chatbots, if I was one of them, I would be more comfortable choosing a provider that is very well known, like the aforementioned IBM, MSFT, or GOOGL. On the other hand, a company that specializes in this specific product instead of being one of the products offered by many, could be appealing to a good number of enterprises, that value focus.

Valuation

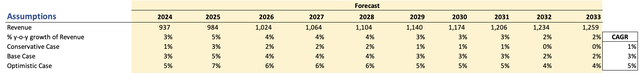

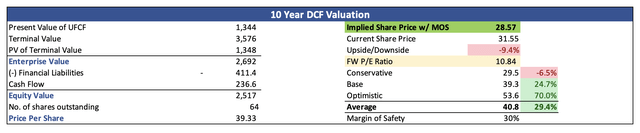

As usual, I will approach the model with a conservative mindset. Looking at the top-line projections, analysts are not forecasting a lot of growth for the next couple of years, which isn’t great, however, these may change over the next year or so if the company can clearly show us that the revenues are accelerating. For now, I will stick to these assumptions as per analysts, and for the rest of the model, I went with a 3% CAGR, which is very low of course, but I haven’t seen much in terms of acceleration just yet. If that changes, I will change my assumptions.

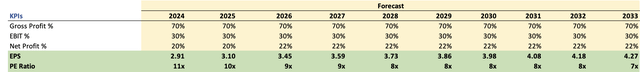

For margins, I went with the company’s adjusted numbers, just because they like to use these more than GAAP numbers. For the model, I kept them static over the next decade, to keep it somewhat conservative.

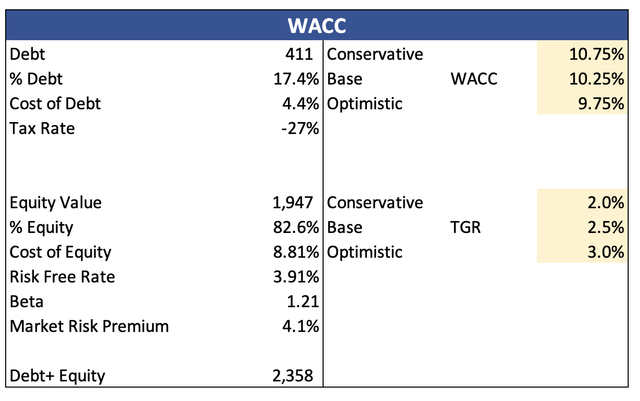

For the DCF model, I went with the company’s WACC of 8.25% as my discount rate, but because of the company’s use of adjusted numbers, I added 2% as a further margin of safety. Additionally, I went with a 2.5% terminal growth rate.

Also, because the company does have a lot of competition, I went ahead and discounted the final intrinsic value by an additional 30%, just to keep it even more conservative. With that said, VRNT’s intrinsic value is around $28.57 a share, which means it is slightly expensive currently.

Closing Comments

I am not in a hurry to start a position right now due to the uncertainties of revenue acceleration and the liberal use of stock-based compensation. It is hard to tell how much the company’s shares are going to get diluted, but it is not going to be beneficial if SBC continues to climb.

I would also like to see how the demand for conversation AI bots progresses over the next few quarters, and whether the company is going to be a major beneficiary of the movement. The competition, as I mentioned briefly, is quite stiff. The bigger players have much deeper pockets but may lack the focus that VRNT has.

I would like to see SBC starting to trend down over the next while, and I hope it is sooner rather than later. The company’s financial position is decent already and if it can work on the remainder of the outstanding debt, it would only be beneficial in the end.

For now, I am initiating my coverage with a hold rating and will follow the company’s progress over the next few quarters.