Aziz Shamuratov

Investment overview

I wrote about Nordstrom, Inc. (NYSE:JWN) previously (early June) with a buy rating as I expected the business to benefit from the current macro backdrop, where consumers are looking for more value purchases given the lower spending power. I give JWN a buy rating as the macro backdrop continues to be favorable and that the margin outlook looks positive over the near term. While I don’t think the board will accept the buyout offer, it should serve as a floor to valuation.

2Q24 earnings (announced on 27th Aug)

JWN reported 2Q24 total retail sales growth of 3.4% y/y, in line with consensus, driving revenue to a total of $3.78 billion. Total revenue is ~$3.894 billion if we include the $109 million of credit card revenue. Positively, adj gross margin expanded by ~160bps from 35% in 2Q23 to 36.6% in 2Q24, which coupled with a flattish SG&A as a percentage of sales (33% in 2Q24 and 32.8% in 2Q23) drove adj EBIT margin to 6.4% (140bps y/y expansion). At the bottom line, JWN reported adj EPS of $0.96, ahead of consensus at $0.71.

Growth outlook remains positive

Recall my previous post, I expected JWN to continue benefiting from the current macro environment where consumer spending is weak, and this played out as expected (evident from the strong Rack sales performance).

In the quarter, the Rack banner saw net sales grow of 8.5% y/y with same-store sales of 4.1%, driven by digital channel traffic growth and new merchandise throughout the quarter. The positive impact seen from the latter point proved that management strategy to lean into strategic brands online is working well. Taking advantage of the demand trend, JWN opened 5 Rack stores during the quarter and plans to open 12 more in 2H24. Despite the potential Fed rate cut over the next few months, I believe the outlook for Rack remains solid. Firstly, the cut in interest rate is very unlikely to translate into immediate consumer spending growth. I inferred this from the fact that the consumer sentiment index remains poor despite news that the Fed is likely to cut rates. Secondly, following on the point on consumer confidence, discretionary spendings have been pulled back, indicating a more value-conscious approach to spending. Thirdly, value retailer peers (like Walmart, Target, and discount stores) have noted solid consumer strength.

As for the full-line business, while performance is weaker than Rack, there are pockets of strength that indicate potential growth acceleration in 2H24. Firstly, management cited consistent flows driving regular price sales and strength in key brands including Vince, Cinq a Sept, and Free People. Secondly, JWN’s anniversary sales saw solid momentum, with beauty and active categories seeing double-digit growth. The key thing to note is that penetration in JWN’s private labels (now 7% penetration) saw mid-single-digit growth during the event, and a primary reason highlighted was that it balanced out the price points (which plays well into the current value-conscious behavior of consumers). Looking ahead, the solid demand trend during the anniversary should have significantly improved product awareness, which bodes well for 2H24 performance—something that management has noted as well.

Gross margin outlook is also positive

Unlike the previous quarter, JWN did well for gross margin in 2Q24, reporting an expansion of 155bps to 36.6%, of which ~80bps of expansion was driven by the recovery in 1Q’s timing-related impacts from loyalty sales and inventory reserves (remember I noted this was 100bps out of the total 225bps contraction) and the remainder from stronger full-price selling, operating leverage, and improvement in store-based shrink. I believe this improvement in gross margin is structural as: (1) the timing-related impacts shouldn’t reoccur; (2) increase sales volume in the coming months, as I discussed above, should continue to drive operating leverage; and (3) shrinkage impact should continue to fall as JWN rolls out its RFID investments across its stores.

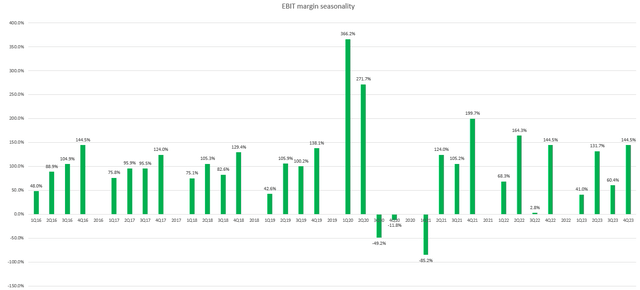

The expansion in gross margin should flow through to the EBIT margin line at a high rate, as demonstrated in 2Q24. Using historical (pre-covid) seasonality, we should see EBIT margin expand even higher in 2H24 (after a deceleration in 3Q). With 2Q24 printing 6.4% EBIT margin (percentage of net sales) and all the demand momentum seen, I think JWN will have no problem meeting consensus FY24 estimates of ~3.7% EBIT margin.

Thoughts about the potential buyout/Valuation

JWN issued a press release stating that the company had received a going-private transaction proposal from the Nordstrom family and El Puerto de Liverpool, S.A.B. de C.V. The proposal indicates plans for the family and Liverpool to acquire all shares of the company for $23 per share in cash. This proposal puts JWN at ~12x FY25 P/E based on consensus estimates. Personally, I don’t think the board is going to accept this offer given the little-to-no premium from the current share price. Moreover, the business has a good near-term outlook, with good demand momentum as seen in the recent results. I also note that the Nordstrom family made a previous attempt to take the retailer private in 2018 at $50 per share. On the flip side, this should put a floor to how much the stock will trade down.

While the upside is less today, given the higher share price today, I think the upside remains attractive. With the valuation likely to remain at 12x forward P/E given the buyout offer and the robust near-term demand outlook, I believe JWN could trade up to ~$23.80 using consensus FY26 EPS estimates (12*$1.98 = ~$23.80).

Risk

The growth seen during the anniversary event may not be indicative of forward demand, since it was promotion-led. If this is true, full-line net sales may fall back to the negative sales trend, and since it represents the larger mix of total revenue, it may drag down overall sales growth. At the macro level, as I noted previously, consumers may cut spending altogether during a recession, which will impact JWN.

Conclusion

I give a buy rating for JWN. JWN’s recent quarterly results showed continued resilience. The combination of robust demand trend, positive margin outlook, and a favorable macro environment paints a positive outlook. Regarding the buyout offer, I don’t think the board will accept, but I believe it serves as a floor for valuation. All in all,