Michael Vi

What Happened in 4Q FY2024 Earnings

Zscaler (NASDAQ:ZS) experienced an 18% selloff after issuing weaker-than-expected earnings guidance, which implies an 11% YoY decline in non-GAAP EPS for FY2025. The company is currently facing growth headwinds amid increased competition in the cybersecurity industry. While ZS’s revenue forecast for FY2025 beat market consensus, the revenue growth outlook signals a significant slowdown in billings and bookings growth, particularly in 1H FY2025. I believe the earnings guidance miss is largely attributable to a weaker margin outlook, as the market had previously anticipated continued margin expansion despite a deceleration in top-line growth. Management indicated that new product launches will initially have lower gross margins. However, it’s still possible for ZS to achieve the “40 Rule” in FY2025. Despite the selloff, the stock continues to trade at a premium valuation of 55x non-GAAP P/E for FY2025, based on the midpoint of the EPS guidance. As a result, I have initiated a hold rating on the stock, as disappointing earnings growth makes the forward valuation multiple appear expensive.

Expect a Significant Slowdown in billings in FY2025

The company model

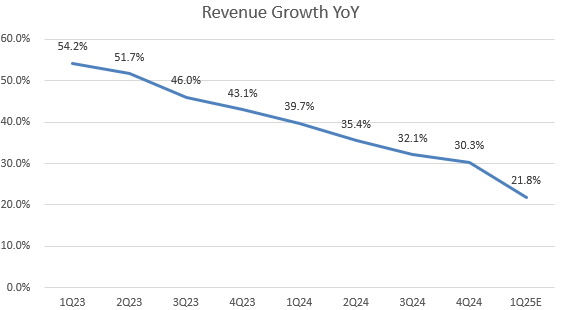

While ZS delivered strong 4Q FY2024 earnings, topping both revenue and non-GAAP EPS estimates, the midpoint of its 1Q FY2025 revenue guidance suggests a YoY growth of 21.8%, down from 30.3% YoY in the previous quarter. As shown in the chart, the implied growth for 1Q FY2025 falls below the prior trend line.

The company model

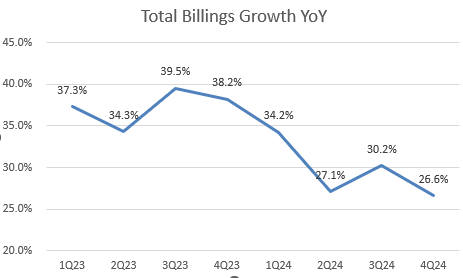

Additionally, ZS’s FY2025 revenue outlook projects 20.5% YoY growth, a sharp deceleration from the 34% YoY growth achieved in FY2024. During the 4Q FY2024 earnings call, management attributed the lowered revenue guidance primarily to a sharp slowdown in billings growth, expecting only 13% YoY growth in 1H FY2025, followed by a gradual rebound to 23% YoY in 2H. Unlike revenue, which can be deferred for recognition on the income statement, billings play a crucial role as a key growth driver, reflecting the actual cash inflow a company receives within a given period. Looking at the chart, we see that its billing growth has come down significantly from FY2023.

The management explained that the improvement in 2H would be largely driven by “stronger sales productivity, a growing pipeline, and increased contracted non-cancelable billings”. However, based on past trends, billings in 1H have historically been higher than in 2H. This irregular pattern raises caution for investors as we notice ZS’s other growth drivers are also slowing down.

My primary concern is that the growth recovery in 2H FY2025 may fall short of market expectations due to potential shifts in macro dynamics, as the probability of recession risk is higher in FY2025. As the management mentioned in the call, “it’s still a challenging spending environment.”

Deteriorating Customer Engagement

The company model

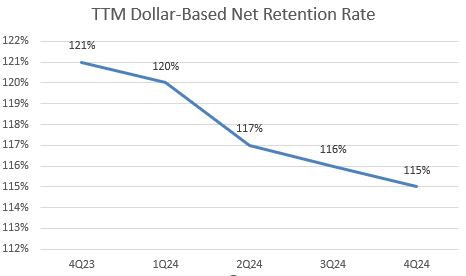

As we can see on this chart, its dollar-based net retention rate (NRR) has been decreasing over the past quarters. Before 4Q FY2023, the company only mentioned that its NRR had been above 125% in its Call Presentation. They explained that the recent drop in NRR was largely due to increased sales on bigger bundles and faster upsells, which can lower NRR in the future. However, it could also be a reason for deteriorating customer engagement as customers may not renew at the same rate as in the past. If NRR continues to drop further in 1Q FY2025, this will confirm the narrative that ZS is losing customer engagement.

The company model

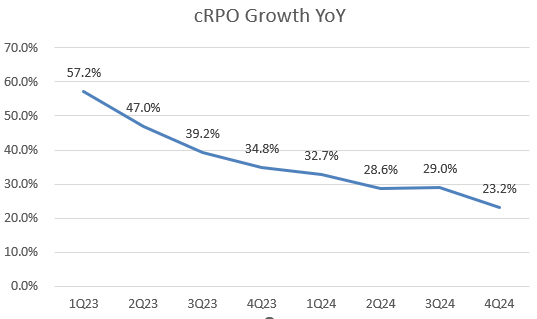

Another metric to focus on is the current remaining performance obligation (cRPO). This represents the company’s contract backlog in the near term (normally in the next 12 months). We can see that the growth rate has been decreasing as well. Therefore, we can conclude that ZS has been facing intensified competition, which will be reflected in its growth outlook in FY2025.

Resilient Margins Could Support “40 Rule” in FY2025

The company model

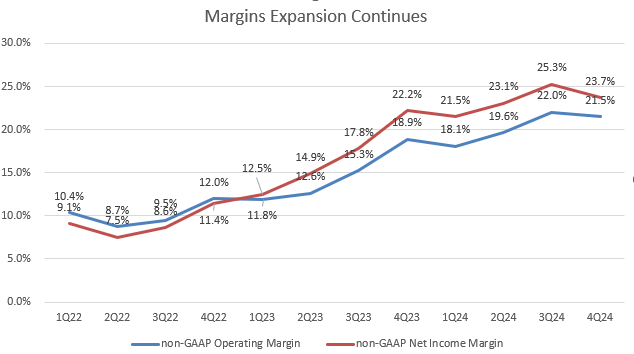

Despite the slowdown in growth and potential declines in customer engagement, ZS has demonstrated strong margin expansion, improving its operating efficiency. Both non-GAAP operating margin and net income margin have maintained an upward trend, as shown in the chart. This has allowed ZS to consistently meet the ’40 Rule’ (revenue growth plus non-GAAP operating margin exceeds 40%). This is a key growth metric for software companies. Over the past four quarters, the company has sustained a combined number above 50%, which supports premium valuation compared to peers.

However, the company’s earnings guidance came in below market expectations, which, I believe, is largely due to potential margin contraction in the coming fiscal year. The non-GAAP operating margin is projected to be 19% in 1Q FY2025, a significant drop from 21.5% in the previous quarter. Additionally, the company expects flat YoY non-GAAP operating margin for FY2025, which may disappoint some investors. Nevertheless, I believe ZS can continue to meet the 40 Rule in FY2025. Based on the midpoint of its FY2025 guidance, with 20.5% revenue growth and a 20.5% non-GAAP operating margin, the combined total is 41%.

Valuation

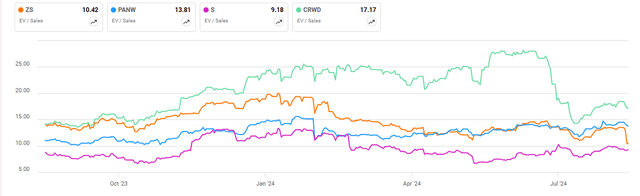

The stock is currently trading at a premium valuation of over 10x EV/Sales TTM, which, I believe, is justified by its +30% revenue growth over the past 4 quarters. As shown in the chart, ZS’s valuation appears cheaper compared to CrowdStrike (CRWD) and Palo Alto Networks (PANW) following the recent selloff. However, with growth expected to decelerate in FY2025, ZS is now trading at 8.6x forward EV/Sales, which seems reasonable given the company is still projected to achieve over 20% YoY growth in FY2025. That said, the combination of slowing growth and flat margins points to a less robust earnings outlook, implying an 11% YoY decline in non-GAAP EPS for FY2025. This will make ZS’s P/E multiple less attractive, making the non-GAAP P/E look more expensive on a forward 12-month basis. Its non-GAAP P/E for FY2025 sits around 55x, which is more than twice as expensive as the S&P 500 index. Therefore, I’m currently neutral on the stock for now.

Conclusion

In summary, while ZS’s potential to meet the “40 Rule” in FY2025 supports its premium valuation, the significant slowdown in billings growth in 1H FY2025, muted margin outlook, and weaker-than-expected earnings guidance raise concerns about the company’s growth momentum in the next fiscal year. With its non-GAAP P/E for FY2025 at around 55x, I believe the stock’s forward valuation does not show an attractive buying opportunity, especially considering the expected deceleration in revenue and flat margin projections. However, if we can see a gradual rebound in billings growth during 2H as management anticipates, I may be more bullish on ZS. For now, I remain neutral on the stock.