jozzeppe/iStock Editorial via Getty Images

Li Auto (NASDAQ:LI) delivered better than expected Q2’24 earnings at the end of August and reported strong delivery growth. The EV maker, also, unfortunately, reported a decline in vehicle margins quarter-over-quarter, a sign that the EV market remains highly competitive, especially for start-ups. Despite the Q/Q margin drop-off, Li Auto has still by far the highest vehicle margin in the EV start-up industry group and convinces with a strong outlook for third quarter deliveries. Li Auto was also once again profitable, making the EV maker one of the lowest-risk investment options in its segment. In my opinion, Li Auto’s low valuation based off of revenue is not justified, and I continue to rate the EV maker’s shares a strong buy.

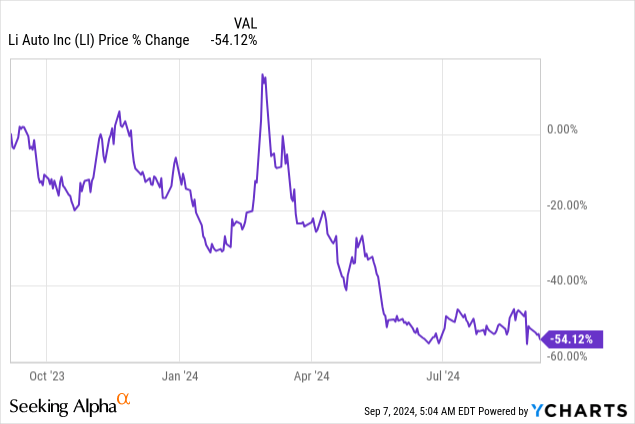

Previous rating

I rated shares of Li Auto a strong buy in May due to the company’s improving margin profile and because an investment in Li Auto had lower risks compared to the firm’s rivals, in my opinion, due to the fact that the EV maker was already profitable: Deep Value For EV Investors. Since then, shares have declined 10% as investors continue to question the validity of EV start-ups’ business models… which in the case of Li Auto seems misguided. Li Auto is profit-making, has a significant margin advantage over other EV start-ups in China and has the strongest Q3 delivery outlook.

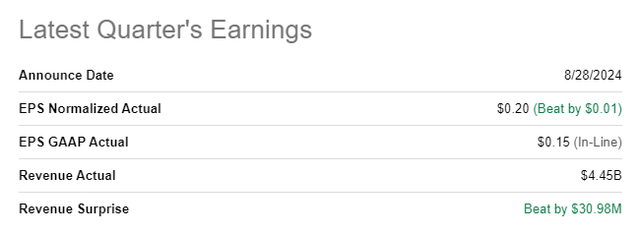

Li Auto surpassed consensus estimates

Li Auto delivered both a top and bottom line beat for its second fiscal quarter at the end of August: the electric vehicle company submitted $0.20/share in adjusted earnings, beating the consensus by $0.01/share. The top line came in at $4.45B and exceeded the average prediction by $31M.

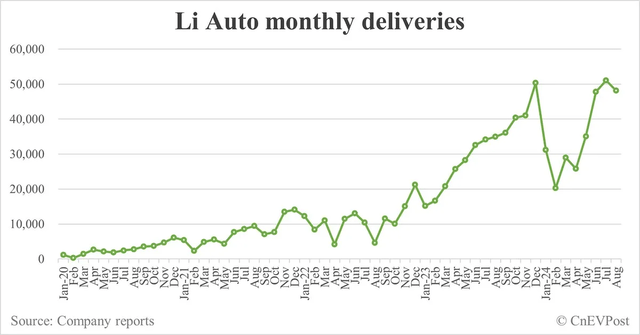

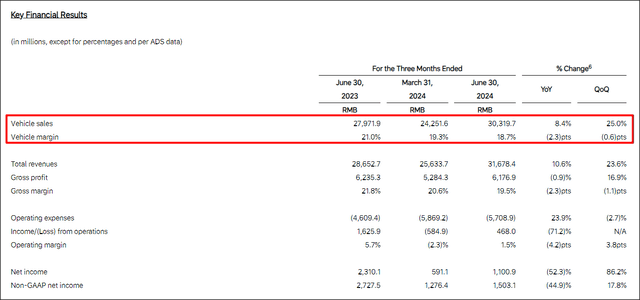

Li Auto’s revenues in the second-quarter surged to 31.7B Chinese Yuan ($4.4B), showing 11% year-over-year growth, chiefly due to considerable growth in the company’s delivery volume. Li Auto delivered 108,581 electric vehicles to its customers during the second-quarter, showing a year-over-year growth rate of 26%. Deliveries in August totaled 48,122 vehicles in August 2024… which was more than twice as much as what NIO (NIO) delivered (20,176 EVs) and more than three times as much as what XPeng (XPEV) accomplished: XPeng delivered 14,036 smart vehicles last month. Li Auto’s delivery chart also showed a nice rebound from the seasonally weak first quarter, which is where deliveries tend to drop off due to the inclusion of Chinese New Year holidays.

The most important metric for Chinese electrical vehicle start-ups is the vehicle margin, which shows how much profit a company is making per vehicle sold. In the second-quarter, Li Auto reported a vehicle margin of 18.7%, which showed a small decline of 0.6% compared to the first-quarter. Despite the decline in margins, however, Li Auto still has by far reported the highest vehicle margins in the Chinese EV start-up group, which includes NIO and XPeng.

For comparison, NIO had a Q2’24 vehicle margin of 12.2%, showing an increase of 3 PP quarter-over-quarter, while XPeng had a vehicle margin of 6.4% (+0.9 PP Q/Q). In other words, Li Auto is still leading the industry group in terms of vehicle margins: its Q2 margins were 53% higher than the margins of NIO, which had the second-highest margins and which saw the largest Q/Q leap in terms of margin growth. XPeng is still lagging behind in terms of vehicle margins, and Li Auto’s margins were 192% higher than XPeng’s in Q2.

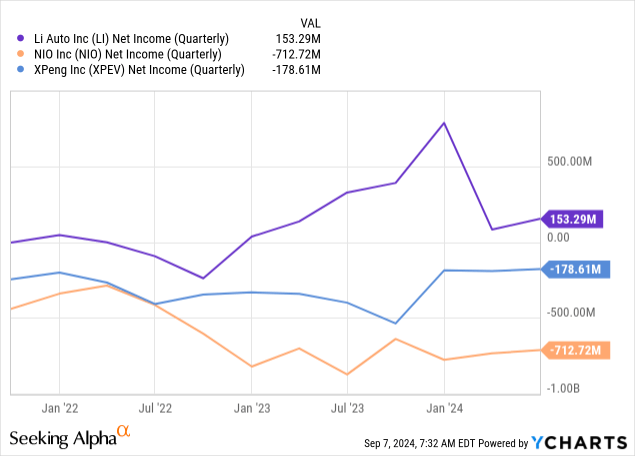

As opposed to other EV manufacturers in China, Li Auto is also solidly profitable which I also see as a key strategic advantage, especially with the market moving towards low-price EV options which could exacerbate margin pressure going forward.

Guidance for Q3

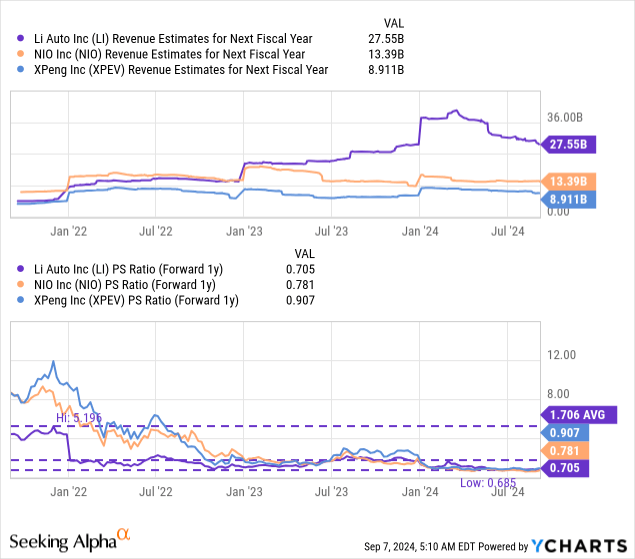

Li Auto guided for 145,000 and 155,000 vehicles, which implies a year-over-year growth rate of up to 48%. Compare this to NIO’s and XPeng’s forecasts of 61-63k and 41-45k deliveries. These estimates imply Y/Y growth rates of up to 14% for NIO and 13% for XPeng. In other words, the short-term delivery outlook also widely benefits Li Auto… which is one reason why I believe that Li Auto’s valuation should be much higher.

Li Auto’s valuation

Li Auto is still the cheapest EV company in the industry group, despite having the highest vehicle margins… which makes no sense to me. Li Auto also compares favorably in terms of absolute delivery volume as well as delivery growth. Li Auto is currently valued at a price-to-revenue ratio of 0.71X, which is well below the company’s 3-year average P/S ratio of 1.71X. Investors (including me) have been overly optimistic about the sales potential in the EV market in the last several years, which has weighed on investor attitudes and which resulted in broad-based valuation drawdowns for electric vehicle start-ups.

In the case of Li Auto, however, I believe investor concerns are misplaced: Li Auto has the fastest delivery growth and highest margins, but coincidentally, also the lowest valuation based off of revenue. In the longer term, I would expect Li Auto to revalue higher as the company grows its deliveries, revenues and earnings. If Li Auto revalues to its longer term P/S ratio of 1.7X, shares could have a fair value of $44 per-share. This is a dynamic number of Li Auto could have a significantly higher long term fair value if it executes well and ramps up its earnings growth.

Risks with Li Auto

Pressure in the global EV market is heating up as more companies now have their own electric vehicles available for purchase in the market. Growing competition has led to downward pressure on vehicle margins, but Li Auto still has significant advantages over the EV competition. Therefore, I continue to see Li Auto as a relatively low-risk investment option in the EV start-up market. Therefore, I see margin pressure as one of the biggest potential issues for Li Auto going forward. A decline in vehicle margins as well as slowing delivery growth are two of Li Auto’s biggest risks.

Final thoughts

Li Auto delivered better than expected second-quarter earnings at the end of August and although the margin drop-off was a bit of a disappointment, the electric vehicle maker’s vehicle margins are still more than 50% higher than those of the second in-line: NIO. Compared to XPeng, Li Auto’s vehicle margins are almost three times higher. Li Auto is also already profitable and convinces with a strong delivery outlook for the third-quarter. NIO and XPeng have a much lower expected delivery volume and are not growing nearly as fast as Li Auto. For those reasons, I consider Li Auto’s valuation to be wholly inadequate and see considerable revaluation potential for Li Auto.