Price: $9.99

(as of Feb 13, 2026 15:31:37 UTC – Details)

🎁 FREE BONUS: Get a printable 30×40 inch poster design with 25 key options strategies (digital file, ready for printing).

Stop guessing why some trades soar while others sink. Start seeing exactly which strategy, DTE, and IV conditions actually make money – based on your own data, not someone’s opinion.

Imagine a journal that doesn’t just store trades but turns them into clear, confident decisions: what to repeat, what to avoid, and how to tune your Greeks and risk so profits become consistent. That’s what this journal does.

Inside this book, you’ll find

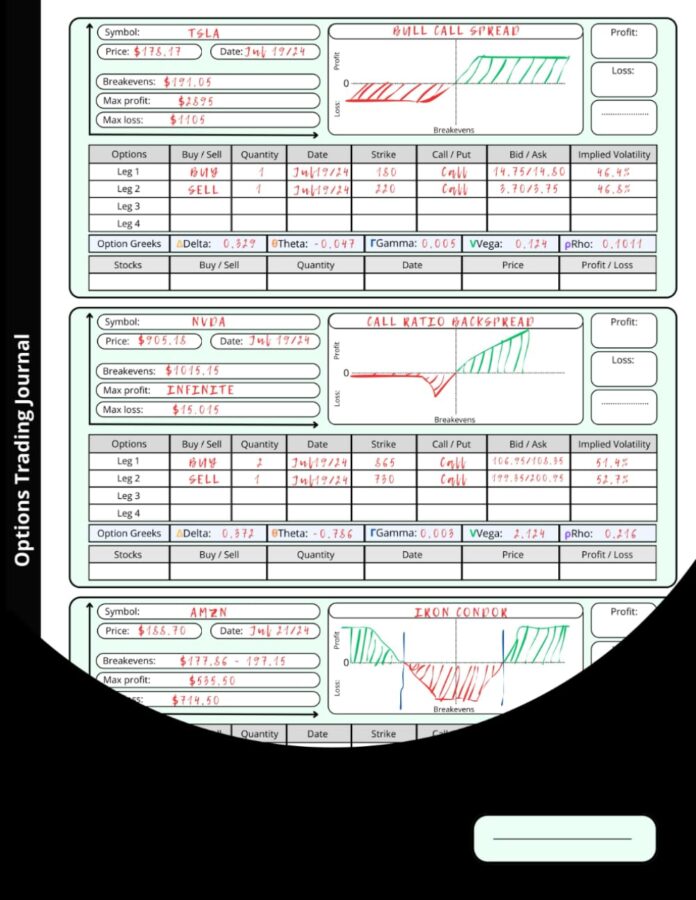

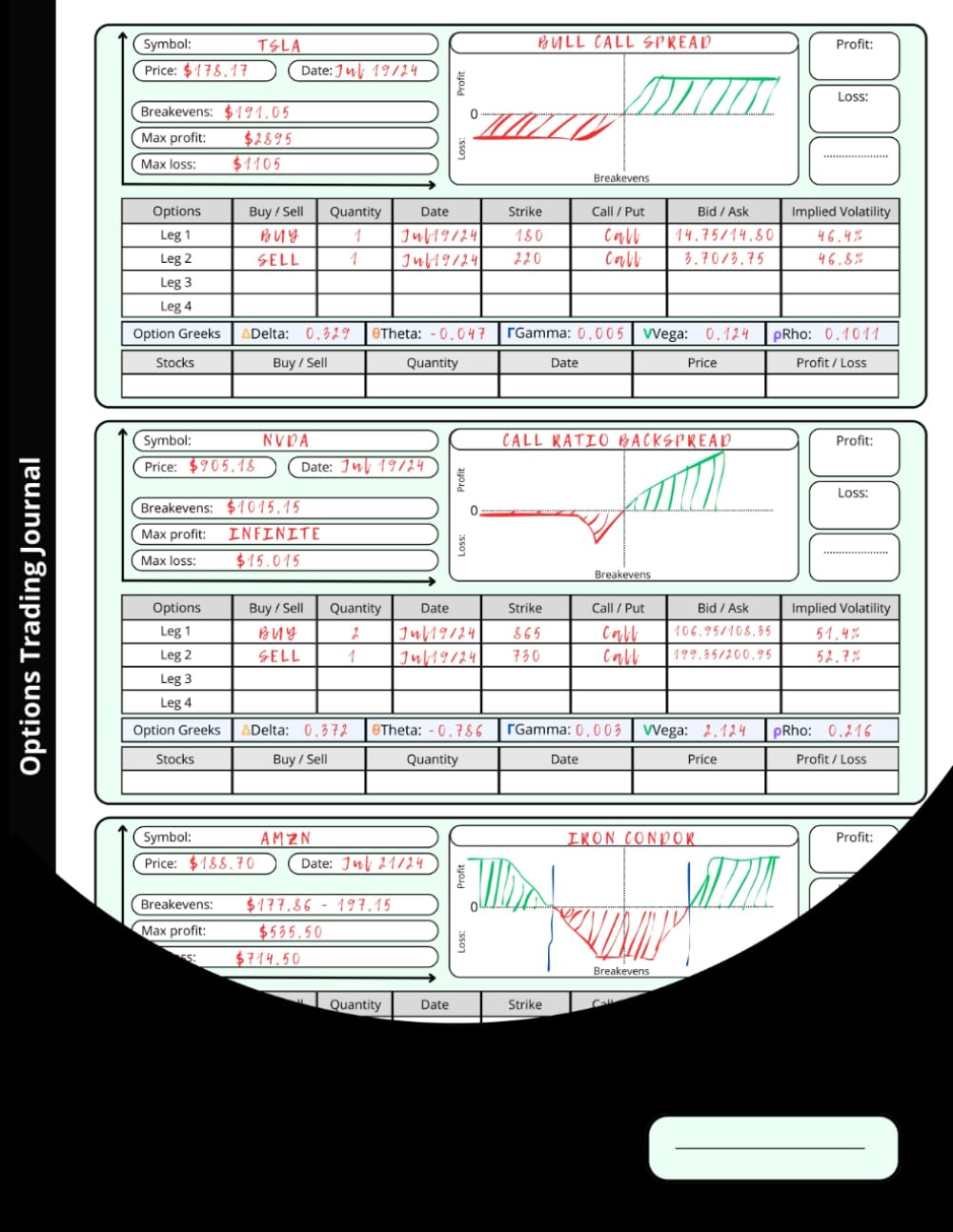

✅ Precise, easy‑to‑scan fields for every options or stock trade: strategy type, contracts, strikes, dates, IV, Delta/Theta/Gamma/Vega/Rho, entry/exit, fees, risk plan, and result – all on one clean page.

✅ 120 pages designed for 357 entries: up to four options trades plus one stock trade per page, so fast trading never kills accurate record‑keeping.

✅ Profit/loss sketch boxes to visualize payoff profiles at a glance – pinpoint break‑evens, max profit/loss, and price sensitivity in seconds.

✅ A wide strategy roster with space to draw: Long Call/Put, Covered Call, Cash‑Secured Put, Iron Condor, Butterflies, Calendars, Diagonals, Ratio Spreads, Straddles/Strangles, Jade Lizard, Double Diagonal, Guts, Strips/Straps, synthetic positions, and Broken – Wing variants.

✅ “Plan vs. Reality” and “Takeaways” sections that expose repeat mistakes (early entries, skipped rolls, holding to expiration in low IV) and convert them into concrete rules.

✅ Clear tagging for fast review: strategy, DTE, IVR, direction, weekday, setup – filter a week of trades in seconds.

✅ Large 8.5×11 in format, high‑quality black‑on‑white interior, and a color cover with sample strategies for quick reference.

Imagine this

After a month, your stats show iron condors with IVR > 30 and 21 – 45 DTE have positive expectancy, while short straddles in low IV drain capital. You stop “feeling the market” and start executing the plan: right DTE selection, disciplined partial profits, faster loss cuts aligned with Greeks and margin. Results stabilize. Decisions calm down.

Why this journal works

📊 Focuses on the true drivers of options outcomes: Greeks, IV / IVR, time to expiration, and position management.

👀 Blends hard data with fast visual review, making lessons from your trades obvious.

🧩 Fits all levels: beginners get structure; experienced traders get a framework for deep optimization.

Perfect for

🧭 Traders building a rules – based system with real edge.

🧑🎓 Learners who want clean, reliable logging of Greeks and setups.

🎁 A practical gift for market enthusiasts – immediate impact on decision quality.

What you’ll achieve

✅ Identify the most profitable strategies and market conditions.

✅ Improve risk control via consistent tracking of Greeks and exit plans.

✅ Turn weekly and monthly reviews into a concrete improvement plan.

🛒 Call to action

Trade by process, not by hope. Get the Options Trading Journal and start documenting, analyzing, and optimizing every position – feel the difference in your decisions and P&L from the very first entry.

Buy now and unlock your true options‑trading potential.

From the Publisher

Add to Cart

Add to Cart

Add to Cart

Add to Cart

Price

$0.00$0.00 $9.99$9.99 $9.99$9.99 $9.99$9.99 $9.99$9.99

Pages

91 120 120 120 120

ASIN : B0D3YDVSPB

Publisher : Independently published

Publication date : May 9, 2024

Language : English

Print length : 120 pages

Item Weight : 13.1 ounces

Dimensions : 8.5 x 0.28 x 11 inches

Best Sellers Rank: #307,382 in Books (See Top 100 in Books) #42 in Derivatives Investments #130 in Options Trading (Books) #421 in Investment Analysis & Strategy

Customer Reviews: 4.8 4.8 out of 5 stars (8) var dpAcrHasRegisteredArcLinkClickAction; P.when(‘A’, ‘ready’).execute(function(A) { if (dpAcrHasRegisteredArcLinkClickAction !== true) { dpAcrHasRegisteredArcLinkClickAction = true; A.declarative( ‘acrLink-click-metrics’, ‘click’, { “allowLinkDefault”: true }, function (event) { if (window.ue) { ue.count(“acrLinkClickCount”, (ue.count(“acrLinkClickCount”) || 0) + 1); } } ); } }); P.when(‘A’, ‘cf’).execute(function(A) { A.declarative(‘acrStarsLink-click-metrics’, ‘click’, { “allowLinkDefault” : true }, function(event){ if(window.ue) { ue.count(“acrStarsLinkWithPopoverClickCount”, (ue.count(“acrStarsLinkWithPopoverClickCount”) || 0) + 1); } }); });