Price: $29.99

(as of Dec 15, 2024 08:12:51 UTC – Details)

ARE YOU TRADING OPTIONS WITHOUT A PLAN?

In this book you will find a complete Trading System using Technical Analysis to find trading opportunities and Options Spreads as the primary trading vehicle. Here are some of the things you can find in this book.Rules for entering trades, exiting profitable trades, stop losses, trade management, portfolio allocation and risk management.Spotting the right trading opportunities using Technical AnalysisA simple strategy that keeps doubling your money over and over againHow to find the right stocks to trade Options.How to avoid falling victim to the GreeksHow to handle market corrections and crashesTechniques to participate in earnings while avoiding the binary outcome of these eventsLive Trade examples elaborating all the concepts in this bookSpecial note on the Market Crash of 2022

From the Publisher

Mean Reversion Trading

USING OPTIONS AND TECHNICAL ANALYSIS

A comprehensive rules-based trading system using technical analysis and options spreads as the primary trading vehicle.

Rules for entering, managing, and exiting tradesRules for profit targets and loss preventionRules for portfolio allocation and risk management ARE YOU TRADING OPTIONS WITHOUT A PLAN?

The leverage that options provide to traders is absolutely mind-blowing.

However, many traders blindly start buying calls and puts without understanding the nuances of the options greeks.

This book provides an easy-to-understand approach to options using vertical spreads and walks you through a comprehensive rules-based strategy which doesn’t require you to get a PhD in the options greeks.

Here are some concepts that you will learn in this book How to pick the right stocks to trade options Technical analysis indicators that matter How to find mean reversion trade setups The power of Debit Spreads Why you should have fixed profit targets How to manage losing trades Trade examples covering all concepts Handling stock market corrections

A 2 Standard Deviation move contains 95% of a stock’s movement

By using Technical Indicators like RSI, ADX, DMI, Bollinger Bands and Keltner Channels, you can spot when an equity is stretched either to the upside or downside and showing signs of reverting back to the mean. Learn how I find these trade setups by using just a handful of technical indicators.

Learn how to find trade setups

An example of an ADSK vertical spread opened using technical analysis. Trades like these can yield a 100% ROI in 30 days or less. Learn how to find stocks which are over-extended to either the upside or downside and about to turn around.

Then use the power of vertical spreads to put on a trade which can double your money even if the stock moves just 5 dollars in 30 days.

Learn how to use VIX to adjust your portfolio exposure

Learn how you can use VIX (The Fear Gauge) to fine tune your portfolio’s exposure to the markets. By using VIX correctly, you will be able to take advantage of stable trending markets to generate handsome returns while avoiding getting wiped out during corrections and market crashes.

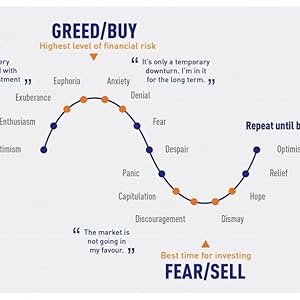

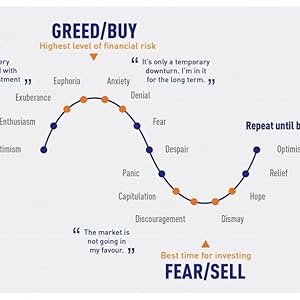

How to avoid the fear-greed cycle

Having fixed profit and loss targets prevents you from getting trapped in the classic fear and greed cycle, which keeps you guessing when to get out of trades. This system lays out rules for getting out of winners at 94% ROI and cutting losers early before they turn into a total loss.

Read the markets like a pro

You have no control over the markets, but the markets have absolute and total control of how your trades fare.

Learn how to read the market weather like a pro and keep an eye on the macro-economic climate.

Learn from example trades

This book not only lays out a complete trading system but also walks you through different trade setups showing you how to put it into practice. In addition to this, there are hundreds of trade examples available on our website to enhance your understanding.

ASIN : B0B7QHRYZ5

Publisher : Independently published (July 27, 2022)

Language : English

Paperback : 311 pages

ISBN-13 : 979-8838380913

Item Weight : 15.8 ounces

Dimensions : 6 x 0.71 x 9 inches

Customers say

Customers find the book easy to read and follow. They appreciate the clear and concise writing style. The information is informative and well-presented, with a rules-based trading strategy that takes emotion out of the equation. Readers also appreciate the risk mitigation strategies included in the book that help prevent account blow-ups.

AI-generated from the text of customer reviews